The BOE, ECB, and RBNZ failed to augment a weak dollar narrative last week but momentum for a strong dollar stuttered instead as short-term dollar bulls reached near term satiation.

For this week, continue to look to the interplay between Fed and ECB rhetoric for any potential extension of DXY upside.

In the interim, note that the broad dollar has garnered slightly less traction even as rate differential arguments continue to implicitly remain in its favor.

Bearish EURUSD scenarios:

1) Growth fails to rebound above 2%;

2) EUR appreciation and/or sluggish core CPI delays ECB policy normalization

3) Eventual repatriation by US corporates.

Bullish EURUSD scenarios:

1) The growth rebounds to 3% by mid-2018;

2) ECB becomes more comfortable with progress on wages and core inflation

OTC outlook:

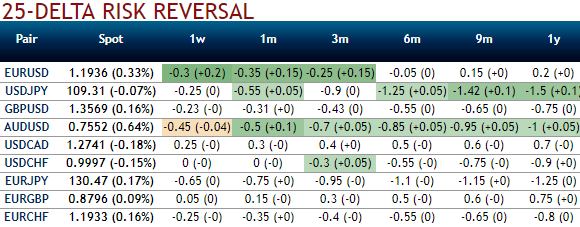

The positively skewed IVs of 1m tenor signify the hedging interest of bearish risks, while you could observe positive shit in bearish risk reversal numbers.

What is interesting here is that the downtrend in EURUSD would have been even more pronounced over the past few weeks if the euro had not appreciated at the same time.

Contemplating above-stated driving forces and OTC indications as shown below, we had advocated options straddle strategy accordingly about two weeks ago on hedging grounds. We now wish them to be reshuffled into strips strategy which contains 3 legs.

Option Strategy: Options Strips

Combination ratio: (2:1)

Rationale: Considering the bearish technical environment in the recent past and ATM implied volatilities of 1m expiries are below 7% which is on the lower side among G7 currency bloc, likely bounce back.

Most importantly, the skews in the sensitivity tool indicate hedging sentiments for the bearish risks, these risks are coupled with bearish neutral risk reversal numbers.

The execution:

Go long in 2 lots of EURUSD at the money -0.49 delta put options of 1M tenors, go long 1M at the money +0.51 delta call option simultaneously.

Margin requirement: No.

Description: Trade the expectation of increased volatility without taking a view on any particular direction. A strategy usually utilized over significant economic data events and other political events.

Effect of Volatility: Directly proportionate to the volatility, the value of both options premiums would likely to enhance as volatility increases (good) and will decrease as volatility falls (bad).

Please be noted that the strategy likely to fetch positive cashflows regardless of the swings with more potential on the downside. Hence, one can deploy this options strategy on hedging as well as speculative grounds.

Currency Strength Index: FxWirePro's hourly EUR spot index is displaying shy above 157 levels (which is bullish). While hourly USD spot index was inching towards -93 (bearish) while articulating (at 06:40 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

FxWirePro launches Absolute Return Managed Program. For more details, visit:

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025