The EURUSD exchange rate was moving in a tight trading range yesterday. However, this was less due to the fact that there was a lack of momentum but the fact that USD strength and EUR strength were roughly evenly balanced. EUR benefitted from strong sentiment indicators as well as speculation that the ECB would surprise on the hawkish side after all tomorrow.

The current option market pricing of 20% overnight vol in EURUSD for the October meeting (refer above table) implies a 0.84% daily spot breakeven on the day, which is closer to the upper-end of our estimated range of EURUSD spot moves between 0.5% -1.0% depending on the tapering package that the Bank announces.

Please be noted that the risk reversals of EURUSD signify the hedgers’ interest for the upside risks.

The degree of asymmetry in expected spot moves vis-à-vis current vol pricing is not enough in our view to motivate owning event risk premium over Thursday.

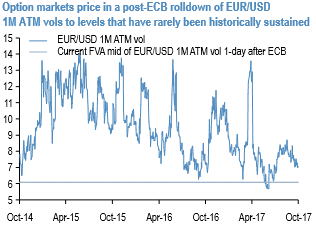

One aspect of short-dated EUR/USD vol surface pricing that does strike us as anomalous is the cheapness of forward volatility priced for after the ECB meeting. The above table shows that the event vacuum after the October ECB is reflected in a1 vol+ rolldown of 1M ATM vols post meeting. The absolute level of the forward vol matters too: 6.1 as the forward level of EURUSD 1M ATM vol after the meeting date at the time of writing is extremely low and has rarely been reached let alone sustained judging by the history of EURUSD 1M vol in recent years (refer above chart).

Additionally, Euro spot has been realizing 6.0 -6.5% in recent weeks even in a quiet market, so there is no risk premium priced into forward vols for any unexpected dollar volatility brought about by either a re-pricing of Fed expectations or more trade/NAFTA/fiscal noises out of Washington.

Owning post-ECB forward vol is therefore much better risk-reward in our view than buying the event itself.

Well, contemplating all the above fundamental factors, on hedging grounds, we uphold longs in a 2m 1.1750 (ATM) - 1.23 EURUSD call spread that was initiated on September 29th. Marked at 42.3bp.

Currency Strength Index: FxWirePro's hourly EUR spot index is gaining traction ahead of this week’s ECB meeting, displays shy above 68 levels (bullish), while hourly USD spot index was inching higher towards 54 (bullish) at the time of articulating (at 06:58 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

Hence, bulls may resume any time upon these indications.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Markets React as Tensions Rise Between White House and Federal Reserve Over Interest Rate Pressure

Markets React as Tensions Rise Between White House and Federal Reserve Over Interest Rate Pressure  OCBC Raises Gold Price Forecast to $5,600 as Structural Demand and Uncertainty Persist

OCBC Raises Gold Price Forecast to $5,600 as Structural Demand and Uncertainty Persist  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Japan Declines Comment on BOJ’s Absence From Global Support Statement for Fed Chair Powell. Source: Asturio Cantabrio, CC BY-SA 4.0, via Wikimedia Commons

Japan Declines Comment on BOJ’s Absence From Global Support Statement for Fed Chair Powell. Source: Asturio Cantabrio, CC BY-SA 4.0, via Wikimedia Commons  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes