As stated in our recent technical write up, EURJPY bulls manage to break out above major resistances of 113.946, 116.250, & 121.526, Current upswings consistently well above DMAs and sustain above these levels would take us to the newer heights.

Today, all focus will also be on the long-awaited ECB meeting. We expect the ECB to announce a six-month extension of its QE program and maintain monthly purchases at EUR80bn. This is probably close to market expectations given a recent Bloomberg survey, where 64% of analysts expected a QE extension with the current pace kept unchanged.

The reason why ECB is widely expected to extend the purchases is that inflation is still not on a sustained path towards 2% despite the latest increase, which is due to energy price inflation (core inflation has remained constant since August).

The market focus has over the past couple of months been focused on the risk of 'tapering' or 'end of easing'. However, in our view, that is premature and we do not expect the ECB to announce any kind of tapering at this meeting.

Instead, focus is likely to be on potential changes to QE buying restrictions like the issuer limit, buying below the deposit floor at -0.40% or potential deviations to the capital key.

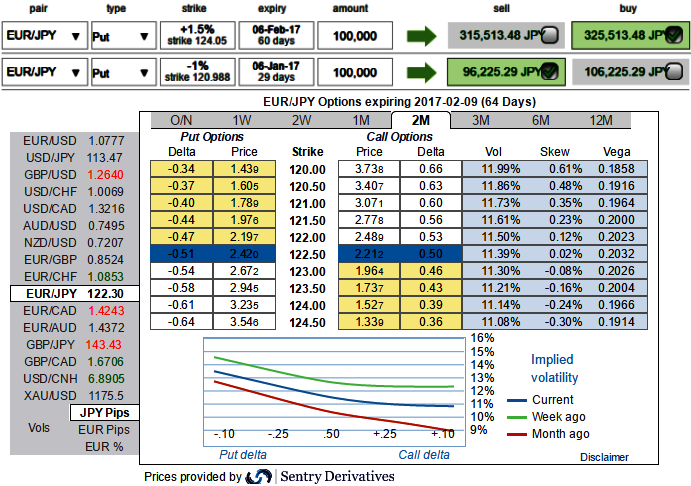

The positively skewed 2m ATM IVs would still keep us alerted on downside risks.

As a result of the short-term bullish trend and any bearish pressures caused by the European central bank, we devise below option strategy in order to monitor both puzzling swings.

The diagonal bear put spread strategy is recommended that involves buying long-term puts and simultaneously writing an equal number of near-month puts of a lower strike.

As shown in the diagram, the strategy is constructed at net debit but with a reduced cost by writing (1%) 1m OTM put option, simultaneously, buying (1.5%) 2m ITM +0.67 delta put options.

This strategy is typically employed when the options trader is bearish on EURJPY spot FX over the longer term but is neutral to mildly bullish in the near term that is stated above.

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand