The main focus of attention for the day has been IFO survey, it has produced upbeat numbers (actual 116 versus f/c 114.9 and previous 115.2) providing a further update on the German economy.

This follows yesterday's ‘flash’ PMI data for July, with German manufacturing and services PMI’s slipping to their lowest level since April and February respectively. While the auto sector woes have been weighing on the German and European equity markets, it has had less effect on the bull phase in the EURUSD. However, a number of EUR crosses look vulnerable to further weakness.

Amid oversold indicators in many key USD pairs, the key question in the market is whether the dollar can continue to fall. Our view is that the USD secular peak was seen in 2Q 2017, so the dollar’s current downtrend will continue to unfold in coming months and quarters.

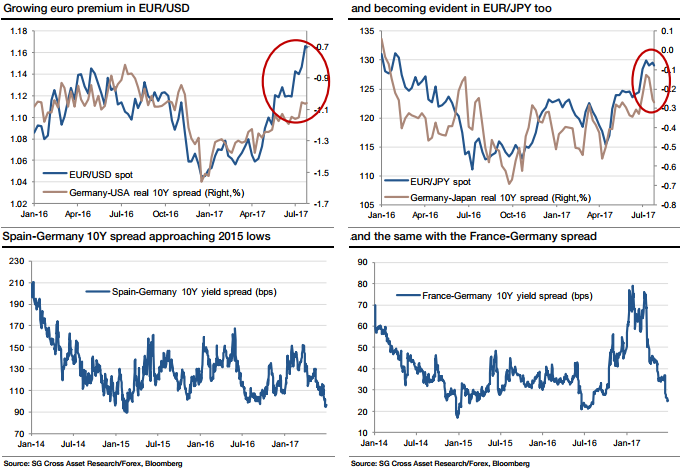

Real yield spreads in both EURUSD and USDJPY have supported a weaker dollar. That being said, it is becoming apparent that there is a growing euro premium, which can be seen even in the EURJPY cross in recent weeks (refer above charts).

After a long absence, peripheral spreads have been re-imposing themselves into euro price action in recent months, and speculative positioning in euro has also climbed relentlessly higher at the same time. However, the Spain-Germany 10-year yield spread is approaching the range lows since 2015, as is the France-Germany spread (refer above charts).

The Fed is widely expected not to announce any new policy measures this week, with the market expecting a balance sheet announcement in the September FOMC.

Moreover, market expectations about Fed rate hikes have receded to such an extent that a less-than even chance of a hike by January 2018 is being priced-in at this point. Apart from the FOMC, the 2Q GDP readings from the UK and US will be in focus, as will the latest CPI inflation numbers from Australia, Japan and Europe.

The list of key market events this week includes:

July 26: Australia 2Q CPI, UK 2Q GDP, US new home sales, and FOMC meeting.

July 27: US durable goods orders.

July 28: Japan CPI, France 2Q GDP, France CPI, Sweden 2Q GDP, Germany CPI, Canada May GDP, and US 2Q GDP.

The dovish extent of the market’s Fed policy expectations suggests that further euro upside requires peripheral spread tightening falling through the 2015 lows.

In both EURUSD and AUDUSD, the tactical risk-reward at this stage is to await a short term pullback for better entry levels for further medium-term upside. Look for EURUSD 1.13 and AUDUSD 0.76 to cushion any corrections.

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns