The Central Bank of Turkey raised its benchmark one-week repo rate by a higher-than-expected 50bps to 8 pct on November 24th and its overnight lending rate by 25 bps to 8.5 pct, while it held its borrowing rate at 7.25 pct.

It was the first policy tightening since January 2014, after the lira fell to a record low amid a slowdown in economic activity.

Consequently, as we urged for the upside potential of USDTRY in our recent posts, the pair’s all-time highs takes off to the new stages, edging towards 3.5 marks. All we could say is that never buck the major trend and the major trend has been the bullish trend but expect interim dips in between for fresh longs.

The Turkish lira weakened sharply in the recent times, with USDTRY surpassing 3.05 range and then to hit fresh highs of 3.4083 levels.

The lira has already lost around 24 pct of its value against the dollar this year on a stronger dollar (from the lows of 2.7891 to the current 3.3408 levels) and concerns over the aftermath of July's failed coup. Inflation was last recorded at 7.2 pct in October, well above central bank's 5 pct targets.

This was definitely in the right direction as a starting point – but it did not work to pacify the lira. This is because the mix of policy measures adopted today showed explicit signs that CBT is having to compromise with government pressure to ease monetary policy; the CB had to cut RRR at the same time that it raised rates.

Hence, question marks linger about whether CBT could go any further if required. We forecast another 50bps rate hike in early 2017 and see USDTRY rising to 3.60 by Q2 2017.

FX Option strategy:

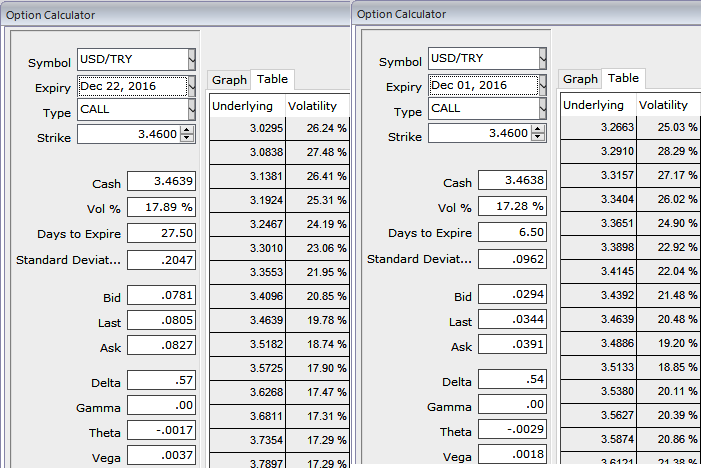

We still uphold the above-advocated FX option spreads as the further upside risks are foreseen and our longs in calls are on pretty well on its functionality, in outright trades, we maintain the longs in USDTRY 1m15d debit call spreads, complementing above aspects and IV shift, the position reduces the hedging cost almost close to 25%.

1m ATM IVs are spiking higher above 17.89%, which is conducive for option holders, Call spreads are preferred over vanilla structures given elevated skew and favorable cost reduction.

Buy USDTRY (3.3580/3.60) call spread with 1m2w at a net debit.

The net delta of the position should be around 48 (3.3580 ITM strike = 78 delta) and selling the upper leg call (OTM strikes) likely to reduce the cost of the ITM call by almost close to 20-25%.

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data