After five consecutive quarters of positive Japanese GDP growth through to Q117, all the evidence currently suggests that the economic expansion is well on track to continue. That is certainly true of the latest business sentiment surveys, with the June Reuters Tankan having suggested that confidence in the manufacturing sector is at a ten-year high. However, the flash June manufacturing PMI released earlier today was a touch disappointing. Having reached a three-year high in February and remained relatively elevated thereafter, the headline PMI slipped more than 1pt to 52, the lowest since November, with the declines of 2pts or more in the output and new orders indices the steepest in more than a year.

There seems little to be concerned about with these latest PMIs. As happened last month, the flash estimates can often be revised very significantly in the final release. And even at the current levels, the indices signal output growth in the sector of 1½%Q/Q or more in Q2. Moreover, a rise in the output price PMI to the highest level since late 2014 suggests that CPI should move steadily higher over coming months, from about 0.5%Y/Y in the current month to about 1%Y/Y in the autumn - pretty much bang in line with our forecast.

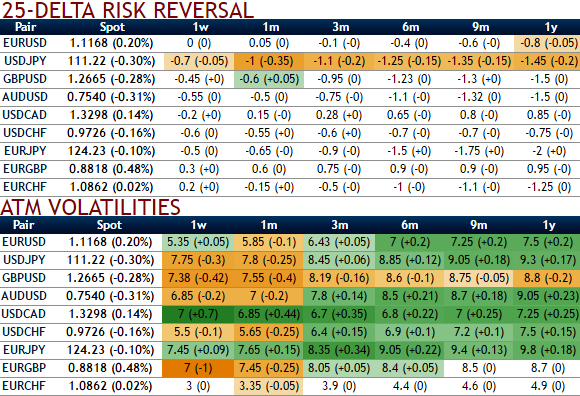

OTC indications and options strategy:

We reckon the below OTC indications and trend in USDJPY seems to be reasonably addressed by bearish hedging participants, hence, we advocate below option strategy to mitigate the uncertainty hovering for downside risks, the strategy likely to keep underlying price risk on check regardless of price swings with cost effectiveness.

Please be noted that the OTC markets for this underlying pair has been indicating the mounting bearish hedging sentiments in both short and long run (see risk reversals through 1w to 1y tenors).

The implied volatilities have been edging higher after dovish Fed fund rate hikes, these IVs have been positively skewed on OTM put strikes.

For aggressive bears, buy a USDJPY debit put spread, 2m 112.50 – 108.700.

For risk averse hedgers, buy USDJPY 1Y ATM straddle. Monetize erratic shifts in US policy focus at minimal carrying costs.

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts