Australia's trade surplus narrowed 58 pct to AUD 0.86 billion in Jun’2017 from a downwardly revised AUD 2.02 billion in May. The trade prints came in which has missed the market consensus of AUD 1.78 billion, as exports fell 1 pct from a month earlier to AUD 31.78 billion while imports rose 2 pct to a record high of AUD 30.92 billion. Considering January to June 2017, the trade surplus was registered at AUD 10.29 billion.

Consequently, Aussie trimmed its recent gains. Although there has been a struggle to sustain recent gains in AUDUSD, we could foresee, in short run, to extend further consolidation phase between 0.7850 and 0.8000.

But medium term perspectives, plentiful of AUDUSD's gains have been driven by broad US dollar weakness. But there has also been a partial recovery in Australia's key commodity prices, after very steep declines in April and May. However, beyond multi-week gains, a firmly on hold RBA is likely to keep a lid on AUDUSD, easing back to 0.74 by this year-end. Our RBA outlook (on hold for some time) is anchoring front end valuations.

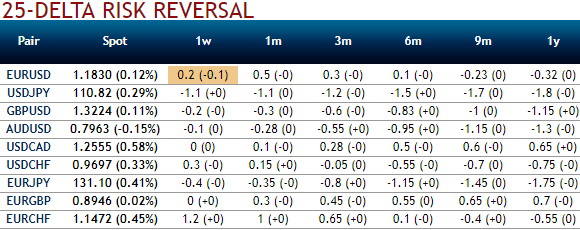

Please be noted that the positively skewed IVs of 3m tenors also signify the hedgers’ interests to bid OTM put strikes upto 0.77 levels (refer above diagram).

While bearish neutral delta risk reversal divulges the interests in hedging activities for downside risks remains intact amid mild upswings.

Well, the bearish stance has been substantiated by AUDUSD's rising IV in 3m and shrinking in 1m tenors with bearish neutral delta risk reversal can be interpreted as opportunity for put longs in long term and theta shorts in short run as the spot FX market reckons the price has downside potential for large movement in the days to come which is resulting option holders’ on competitive advantage.

Accordingly, we had advocated put ratio back spreads a couple of days ago, wherein short leg is functioning as the underlying spot FX keeps spiking.

So, the speculators and hedgers for bearish risks are advised to capitalize on the prevailing rallies and bid on 1-3m risks reversals to optimally utilize Vega longs.

We advocate weighing up above aspects and uphold the same option strategy on hedging grounds, we eye on loading up with fresh Vega longs for long term hedging, more number of longs comprising of ATM instruments and ITM shorts in short term would optimize the strategy.

So, the execution of hedging positions goes this way:

Short 1m (1%) OTM put option as the underlying spot likely to go either sideways or spike mildly, simultaneously, go long in 2 lots of Vega long in 3m ATM -0.49 delta put options.

A move towards the ATM territory increases the Vega, Gamma, and Delta which boosts premium. However, Theta (time decay) also increases especially as expiry approaches. Hence, OTM shorts in calls in such scenario are most suitable for speculation.

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty