Gold futures contracts for December delivery on the Comex division of the NYME surges 0.07% to $1,277.74 a troy ounce.

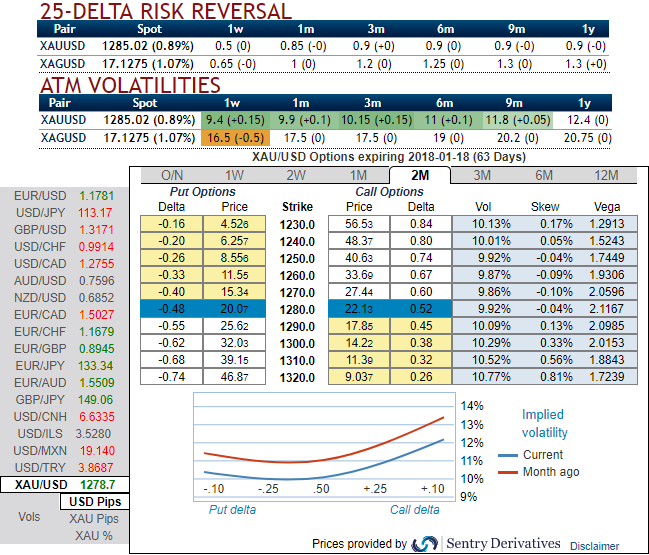

It is reckoned that as per the OTC indications as shown above and the prevailing trend in bullion markets seem to be reasonably addressed by hedging participants, thus, we advocate below option strategy to keep uncertainty in spot gold prices on the check. On trading perspective also, the strategy likely to fetch positive cashflows regardless of underlying price swings with more potential on the downside and with cost-effectiveness.

Hedging Framework:

Strategy: 2m 3-Way Diagonal Straddle versus OTM Put

Spread ratio: (Long 1: Long 1: Short 1)

Rationale: Let’s glance on sensitivity tool, the bullish neutral risks reversals indicate upside risks in underlying spot gold prices, while lower implied volatilities with well-balanced positively skewed IVs signify the put writers’ advantages.

For 2m IV skews would signify the interests of OTM call strikes that means the ATM calls higher likelihood of expiring in-the-money, so writing overpriced OTM puts would be a smart move to reduce hedging cost.

The execution:

Go long in XAUUSD 2M at the money -0.49 delta put, and go long 2M at the money +0.51 delta call and simultaneously, Short 2W (1%) out of the money put. Thereby, we favor bulls as we foresee more upside risks by keeping longer tenors on call leg.

Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields