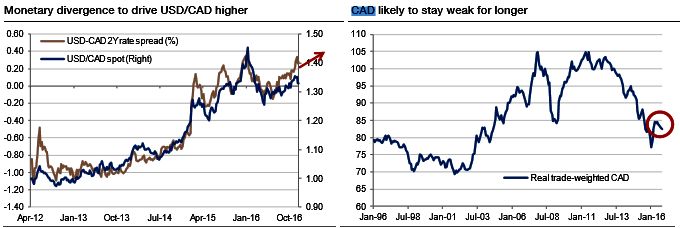

BoC firmly on hold: The lukewarm outlook indicates that the Bank of Canada would keep policy steady in the face of Fed tightening, which should nudge USDCAD gradually higher through mid-2017. The loonie remains highly correlated to oil prices, but it will likely not be able to resist broad US dollar strength (refer above graph).

Following last month’s Bank of Canada (BoC) meeting the question arises as to whether the central bank is still in control. Its view of the economic situation and therefore in the end also its future monetary policy depend on the expected trade policies of the new US President Donald Trump.

The data are mixed, and not supportive of a material shift in BoC stance.

OTC updates and hedging vehicles:

Hence, at spot ref: 1.3966 (while articulating) we advocate below FX derivatives strategy as we favor optionality to the directional trades. After a series of bearish streaks in this week, we are inclined to position for a partial retracement of the down move through put spreads, as calling the bottom is difficult and adding directional spot exposure is risky at the moment.

Alternatively, using any abrupt rallies, you decide to initiate a diagonal debit/bear put spread (DDPS) at net debit 1w ATM IVs of EURCAD is at 7.69%, and likely to spike higher 8.4% in 1-3m tenor.

The execution: Initiate shorts in 1W (1.5%) out the money put with positive theta, simultaneously, buy 1M in the money -0.5 delta put option. Establish this option strategy if you expect that EURCAD would either expect sideways or spike up abruptly over the next near future but certainly not beyond your upper strikes.

China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist