We all know that there exists a positive correlation between CAD and crude oil prices, this week’s report was bearish for crude but bullish for gasoline and distillate.

Moving to global oil markets, Brent backwardation continues to indicate tightness in sweet crude. However, US sweet crude exports (of 1.92 Mb/d last week and 1.74 Mb/d in the last 4 weeks) continue at high levels.

OPEC is scheduled to meet on November 29th, when the producer club is expected to decide whether to continue output cuts aimed at propping up prices.

Oil prices now probably discount a full nine-month extension to OPEC cuts. Using current option pricing as indicative of market consensus suggests that the market currently ascribes a roughly one in three chance (33% to be more precise) for Brent prices averaging $50/bbl or below in December 2018.

While Industry group the American Petroleum Institute is due to release its weekly report at 21:30GMT Tuesday. Official data from the Energy Information Administration will be released Wednesday, amid forecasts for an oil-stock drop of around 2.1 million barrels.

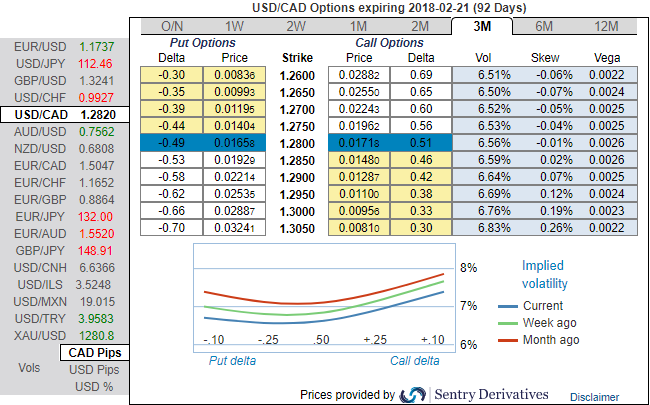

Please be noted that the positively skewed IVs of 3m tenors are stretched to bid OTM calls strikes. While risks reversals of this tenor are indicating bullish risks owing to the above-stated risk events.

Thus, we advocate buying USDCAD 3m risk reversal strikes 1.3440/1.2450 (at spot ref: 1.2805).

The recommended skews and risk reversal structure (refer nutshells) takes direct advantage of the cheap skew opportunity.

It is expected that any CAD downside to be volatile, as it would likely be caused by geopolitical tensions and/or market unwind. This justifies owning topside convexity and volatility.

Pure volatility investors may implement active delta-hedging to get direct exposure to the skew while getting rid of the directional risk.

Given the downside risks attached to CAD appreciation, we would advise directional investors to implement a delta-hedging strategy involving a negative pre-defined mark-to-market threshold.

Risk profiling: Unlimited below 1.2450, investors face unlimited risk if USDCAD trades below the 1.2450 strike in three months.

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics