Buying double-no-touch strategy on a directional trading grounds (DNT):

As stated in our technical write-up, the underlying pair (USDJPY) has been constrained in the long-lasting range and tepid IVs, we could foresee opportunities in directional trades.

The view of this pair’s range and capped volatility directly suggests a Double No Touch (DNT) implementation. The risk is limited to the premium and the volatility profile is very interesting for the specific USD risk.

This option is short vega, so that it benefits from lower implied volatility. It is also long volga, which means positive exposure to the volatility of volatility, and therefore to tail risk.

With a market horizon as long as six months and a decent volatility risk premium, the market implied probability of hitting the bounds of such a payoff will be sufficiently high to produce attractive leverage.

USDJPY is in the middle of the 114.733 – 107.203 range is an attractive entry point. In current market conditions, setting the DNT bound in the same range that is likely to produce leverage above 7 times.

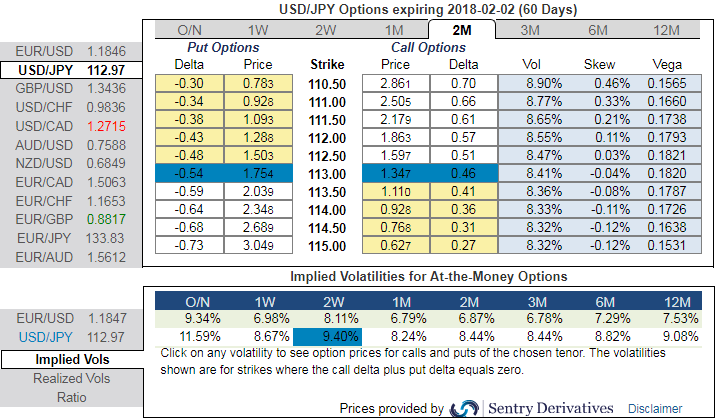

Alternatively, OTC hedging arrangements for downside risks seems intact despite Fed’s rate hikes on the eve of Christmas, you could make this out from the above nutshell evidencing risk reversals, while IVs are spiking higher (for 3m tenors) which is in tandem with the above mentioned underlying forecasts and its rationale.

The nutshell is still showing negative risk reversals that are bids for the hedging for the downside risks but with positive shifts. Thus, it is deemed as the puts are on more demands over calls. The negative risk reversals across all tenors are indicating the bearish hedging interests.

Please also be noted that the 2w OTM puts are overpriced 31% more than NPV, whereas 2w IVs are below 10%. Amid bearish neutral risk reversals with this considerable disparity between IVs and option pricing, we see an ideal shorting opportunity for option writers in such overpriced OTM puts.

The delta risk reversal across all tenors divulge shifting sentiments in bearish hedging, however, the risk mitigation activities for downside risks remain intact.

To substantiate this bearish hedging interests, positively skewed IVs of 2m tenors bid for OTM put strikes.

Please note that 2m IVs skews bidding for 110.50 or below levels.

Option Trade Recommendation:

Weighing up above aspects, we eye on loading up with fresh longs for long-term hedging, more number of longs comprising of ATM instruments and ITM shorts in short-term would optimize the strategy.

So, the execution of hedging positions goes this way:

Short 2w (1%) OTM put option as the underlying spot likely to spike mildly, simultaneously, go long in 1 lot of long in 1m ATM -0.49 delta put options and 1 lot of (1%) ITM -0.55 delta put of 2m expiry.

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures

U.S. Treasury Yields Expected to Decline Amid Cooling Economic Pressures  UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data

UBS Predicts Potential Fed Rate Cut Amid Strong US Economic Data