The Aussie has bounced around 2 cents since early October, aided by a more positive tone on the US-China trade talks and the unexpected Brexit breakthrough which has bolstered global risk appetite.

AUD should remain supported near term but any trade in the 0.6950/0.7000 area is likely to attract substantial sellers. While supply interruptions could limit the recent fall in iron ore prices, coal prices remain near 3-year lows and we expect the US and China to reach only a very limited trade agreement in coming weeks.

Moreover, the RBA does not want to encourage an A$ revival and pricing for another rate cut has been unwound too far, as we still expect a rate cut in Feb 2020. Our year-end target remains 0.66 levels.

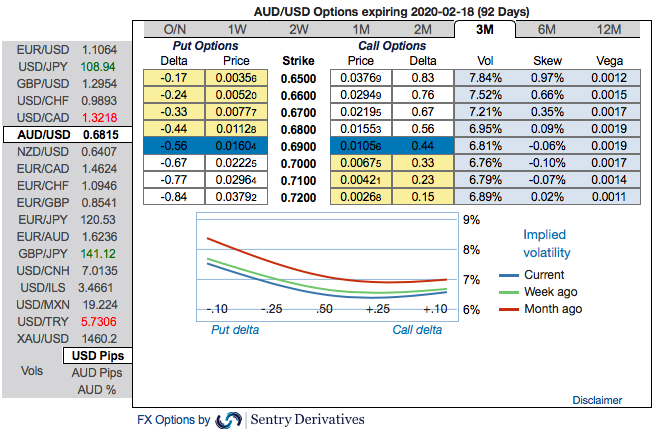

Ahead of RBA’s monetary policy scheduled for the next week, the OTC outlook of AUDUSD are useful for the options strategic framework.

Please be noted that the positively skewed IVs of 3m tenors still signify the hedgers’ interests to bid OTM put strikes up to 0.65 levels which is still in line with the above bearish projections (refer 1st nutshell).

Please also be noted that bearish risk reversals (RRs) across all the longer tenors are also in sync with the bearish scenarios amid momentary shift in mild upside risks (refer 2nd (RR) nutshell).

In a nutshell, AUD OTC hedgers’ sentiments substantiate that their risk mitigating activities for the downside risks has been clear.

The combination of AUDUSD’s short-term potential to break above 0.6930 and lower IVs is luring for the OTM put options writers. While the medium-term perspective is attractive for bearish hedges via ITM puts.

Accordingly, diagonal put spreads are advocated to mitigate the downside risks with a reduced cost of trading.

The execution of options strategy: Short 2w (1%) OTM put option with positive theta (position seems good even if the underlying spot goes either sideways or spikes mildly), simultaneously, add long in 2 lots of delta long in 3m (1%) ITM -0.79 delta put options.

Alternatively, on hedging grounds ahead of RBA’s monetary policy that is scheduled for the next week, we advocate shorting futures contracts of mid-month tenors as the underlying spot FX likely to target southwards below 0.66 levels in the medium run. Writers in a futures contract are expected to maintain margins in order to open and maintain a short futures position. Courtesy: Sentrix, Saxo & Westpac

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Markets React as Tensions Rise Between White House and Federal Reserve Over Interest Rate Pressure

Markets React as Tensions Rise Between White House and Federal Reserve Over Interest Rate Pressure  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  U.S. Prosecutors Investigate Fed Chair Jerome Powell Over Headquarters Renovation

U.S. Prosecutors Investigate Fed Chair Jerome Powell Over Headquarters Renovation