British pound consolidates as Brexit risks simmer. But one could retain unrestrained exposure to GBP weakness by fashioning short GBPUSD exposure out of zero-cost long GBP put/CHF call vs. short USD put/CHF call option switches (live options, not delta- hedged). Conceptually, such a long/short option spread expresses a short GBPUSD delta view.

Usually, GBP bearishness is premium-intensive to own owing to the steepness of GBP put skews, however, the costless bearish GBP switches using identical tenor and moneyness strikes are made possible in this instance by a combination of dual factors.

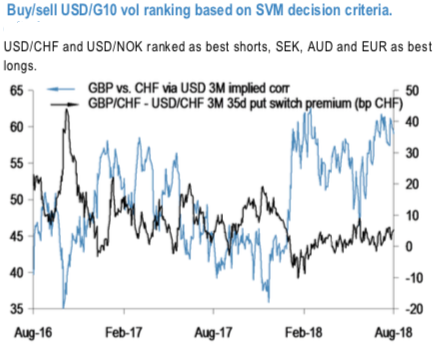

First, GBPCHF implied vols have been crushed by not only a broad compression of G7 FX risk premia but also by an increase in GBP vs. CHF via USD correlations towards historic highs over the past few months of dollar-centric price action in currency markets (1stchart).

Second, the choice of USDCHF as the funding leg of the RV is as important as long GBPCHF, since realized vols in the pair have consistently disappointed and risk-reversals have been over-priced for USD puts for a while as an artefact of the market’s long memory of the franc de-peg.

(2ndchart) presents the empirical evidence of the efficacy of such spread structures for playing GBP weakness: equi-notional GBPCHF – USDCHF switches have out-delivered standalone GBP puts/USD calls since the onset of the GFC but at a fraction of the cost of the latter or even net premium credit at times. The steepness of GBP forward points curve outweighs the steepness of the vol curve such that longer expiries are more favourable from a pricing standpoint; 9M expiries also cover the scheduled Brexit deadline of 29 March 2019 and the potential volatility over that period:

Off spot refs. 1.2702 and 0.9941, long 9M 2% OTMS GBP put/CHF call vs. short 9M 2% OTMS USD put/CHF call switch, equal CHF notionals on both legs costs 25bp CHF of premium credit at inception (indic. vols 8.7/9.1 vs. 7.5). For comparison, the corresponding 9M 2% OTMS GBP put/USD call equivalent costs 254bp (mid).

Ultimately, a bearish GBP standpoint could be leveraged further by merging with the macro team’s constructive take on another European currency such as CHF in multi- currency format. For instance, a 9M (GBPUSD < 2% OTMS, USDCHF < ATMS) dual digitals that take advantage of the aforementioned correlation set-up cost 14.2% of USD payout, 47% discounted to the cheaper of the two (GBPUSD) legs. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly GBP spot index is displaying shy above -113 levels (bearish), while hourly USD spot index was at -118 (bearish), hourly CHF was at -3 (neutral), while articulating (at 13:40 GMT). For more details on the index, please refer below weblink:

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics