AUDUSD is correcting the April rally, the pullback possibly extending to 0.7700.

The medium-term perspectives: The Aussie remains pricey compared to short-term fair value estimates. Yield differentials along the curve continue to move steadily in the US dollar’s favor, but the more notable move in recent weeks is the slide in commodity prices, including a 20% drop in spot iron ore in March.

Optimism over global growth is being challenged by US-driven trade tensions which pose downside risks to global trade volumes and AUD. But with the sentiment on the US dollar lukewarm, the pressure on AUD is mostly via crosses. We look for USD0.77 end-Jun, and 0.74 end-Dec.

OTC outlook and hedging perspectives:

While using rising IVs of longer tenors coupled with the positive shifts adding to risk reversal numbers, while positively skewed IVs on OTM put strikes could be interpreted as an opportunity to deploy longs in OTM puts with theta shorts in ITM put on time decay advantage as the spot FX market reckons the price has downside potential for large movement in the days to come which is resulting option holders’ on competitive advantage.

Without disregarding the Fed’s further rate hiking cycle in 2018, the bearish stance of the pair has been substantiated by technical indications (as stated in our recent post, refer our technical section) and positively skewed IVs of 3m tenors which is an opportunity for put longs in long-term as the US central bank likely to continue hiking phase.

Accordingly, we had advocated put ratio back spreads a couple of days ago, wherein short leg is functioning as the underlying spot FX keeps spiking.

Both the speculators and hedgers for bearish risks are advised to capitalize on the prevailing price rallies by bidding 3m theta shorts, 3m risks reversals to optimally utilize Vega longs.

On hedging grounds, fresh Vega longs for long-term hedging, more number of longs comprising of OTM instruments and ITM shorts in short-term would optimize the strategy.

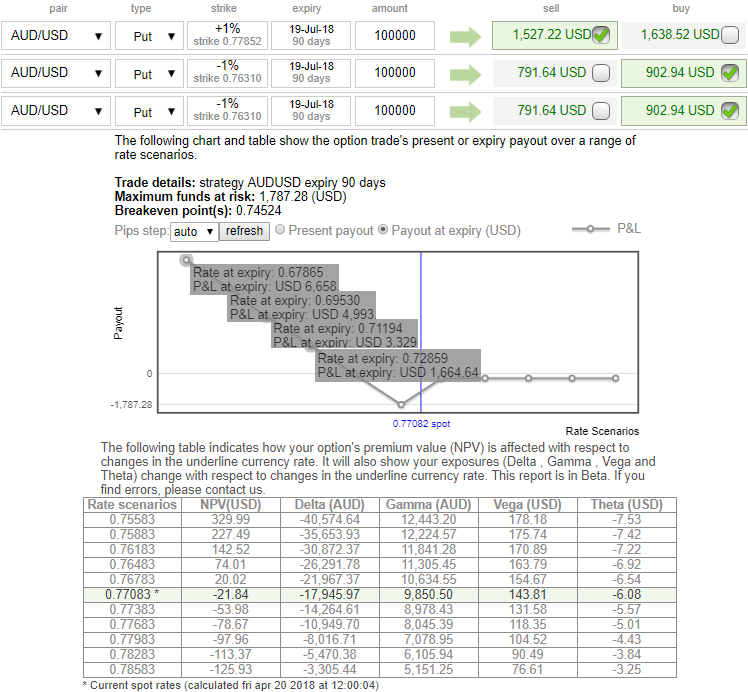

So, the execution of hedging positions goes this way:

Short 3m (1%) ITM put option, simultaneously, go long in 2 lots of vega long in 3m (1%) OTM -0.39 delta put options. A move towards the ATM territory increases the Vega, Gamma, and Delta which boosts premium.

Thereby, the above positions address both upswings that are prevailing in short run and bearish risks in long run by vega longs.

Precisely from the above payoff graph, we can comprehend –

1. If underlying spot FX slides down, then the profits are unlimited (refer positive shift in payoff structure).

2. Well, there is only one breakeven point at 0.7451 levels.

3. The spot FX point at which highest loss occurs is at 0.7629 levels.

4. If spot FX markets spike up, then the yields would be limited.

Currency Strength Index: FxWirePro's hourly AUD spot index is inching towards -76 levels (which is bearish), while hourly USD spot index was at a tad below 115 (bullish) while articulating (at 06:34 GMT). For more details on the index, please refer below weblink:

http://www.fxwirepro.com/currencyindex.

FxWirePro launches Absolute Return Managed Program. For more details, visit:

European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential