In December 2016, the dollar reached its third and smallest significant peak (in real terms) since 1980. The question of cheap short dollar hedges has frequently arisen in the recent past. In our latest write-ups, it was screened for highly levered standalone USD calls (2M 5:1 one-touches) that offered the highest ex-ante odds of paying out in the event of a dollar reversal, and surmised that Gold, ZAR and AUD puts/USD calls offered the most value for hedgers; this section extends the dollar hedging question here to relative value constructs.

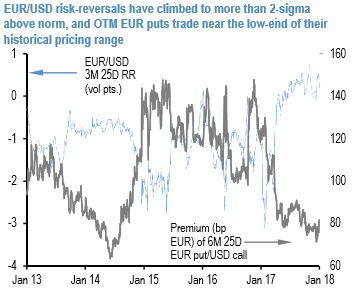

1. Long EUR puts/USD calls vs. short EUR calls/CEE and Scandinavia puts: A notable by product of the ferocious dollar sell-off of the past few weeks is that risk reversals have re-priced sharply away from USD calls towards USD puts, and currently trade close to zero, or even in favor of USD puts in some G10 majors. EURUSD is one of the most extreme examples of this dynamic, where RR/ATM ratios have risen to 2-sigma above the norm (3M 25D r/r +0.3; refer above chart). The rare surface configuration of a vol discount on OTM EUR puts, coupled with positive forward points carry on bearish Euro bets motivates cheap option protection for long cash positions. The clean hedge is to buy outright OTM EUR puts/USD calls that trade near the low end of their historical price scale (refer above chart).

2. Long USD calls/CNH puts vs. short EUR calls/CNH puts: Short USDCNH is a well subscribed to directional view, in part as a positive carry beta expression of dollar weakness / Euro strength with solid growth differential underpinnings, and partly for alpha reasons related to trade friction related official tolerance for a stronger Renminbi.

Much like EURUSD, USDCNH risk reversals have compressed sharply amid the 4.5% drop in the spot since December – 1M 25D skews even flipped briefly for USD puts at one stage – and are depressed relative to ATM vols and implied yields in forwards. Unlike with the Euro, however, owning USD calls/CNH puts standalone as a dollar reversal hedge is expensive on account of the negative carry in points despite cheap vols.

For more details on the index, please refer below weblink:

China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Global Markets React to Strong U.S. Jobs Data and Rising Yields

Global Markets React to Strong U.S. Jobs Data and Rising Yields  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty

UBS Projects Mixed Market Outlook for 2025 Amid Trump Policy Uncertainty  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges