On Wednesday, the new trade negotiations will begin between the US and China and the annual economic conference in Jackson Hole organised by the Kansas Fed will also begin on this Thursday. Both events mark the two factors that currently drive USD exchange rates: the US government’s trade policy and the Fed’s monetary policy.

While in the recent past, Bank of Japan (BoJ) confirmed rumors and tweaked by announcing a shift to the range of assets it would buy as form of its yield curve control strategy and introducing extensive "forward guidance" committing to low rates for a prolonged period of time. It would now allow larger volatility of the 10y yield around its 0% target, while it still plans to counteract excessively rapid increases in the yields. However, the market reaction to last week’s media reports probably showed the central bankers that this adjustment left alone would result in an appreciation of the yen.

USDJPY tend to plunge during summer vacation season ("Obon" in Japanese language which is in mid-August). Such seasonality is not strong, but USDJPY showed tendency to decline for the first 10 days of August. Especially in the past 5 years since Abenomics started, the pair dropped during the first 10 days of August four times out of five.

Off spot reference: 110.61, buy a 1M 111.1151 /109 put spread indicatively (vols 7.4/7.6 vs 8.05 choice).

The maximum payout is 115bp, max payout/cost ratio is 3.2, and the put spread is 53% discounted to a standalone 1M 110.25 USD put/JPY call.

The rationale for the put spread structure is two-fold:

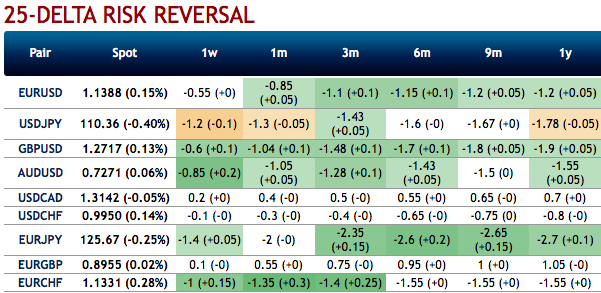

a) It takes advantage of the recent widening of short-dated risk reversals in favor of JPY calls to reasonably stretched levels adjusted for the level of ATM vol.

USDJPY 1M 25D risk-reversals currently imply a spot-vol correlation level of around -38%, which is not a historically high bar for realized spot-vol correlation to beat but is nonetheless expensive vis-à-vis recent delivered numbers (2-wk +25%, 1-mo +10%) and supportive of skew selling option structures such as put spreads; and

b) The extent of any potential yen strength from here is likely to be capped in the fundamental view, specifically after the knee-jerk decline in USDJPY spot late last week. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly JPY spot index is flashing at 27 levels (which is mildly bullish), while hourly USD spot index was at -27 (mildly bearish) while articulating at (07:55 GMT). For more details on the index, please refer below weblink:

2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data

Oil Prices Dip Slightly Amid Focus on Russian Sanctions and U.S. Inflation Data  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist