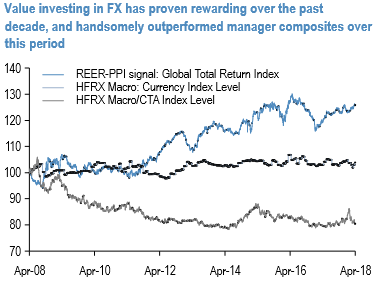

For an asset class widely considered to be a haven for trend following investors, fundamental value-based strategies in foreign exchange have performed commendably over the past decade. The above chart plots the total return stream from holding monthly re-balanced long/short baskets of the most over-and under-valued currencies among a panel of G10 and EM FX based on the deviation of their PPI-based real effective exchange rates (REERs) from 15-year moving averages.

If long-term value indicators have predictive power for future trend reversals in exchange rates, our interest from a volatility standpoint is to identify pockets where option markets grossly miscalculate the probability of such shifts and hence reward potential investors to enter into leveraged medium-term mean-reversion opportunities.

The above nutshell attempts to do this by comparing and contrasting FX valuation skews with option pricing skews. The former is simply the deviation of REERs from 15-yr averages –the same indicator used in Exhibit 5; the table simply lists those that exceed an arbitrarily high threshold of 10% in either direction, so represents asymmetric odds of a valuation correction over the next 12-18 months. The skewness of option pricing is represented by the difference in prices of 1Y 5% and 10% OTMS strike at-expiry digital call and put options.

MXN and TRY-crosses feature heavily in the list of currency pairs where the likelihood of mean-reversion of deeply over-/under-valued REERs is priced by option markets to be extremely low odds compared to that of a continued widening of their deviation from historical norms from already wide levels Currency valuation skew measured as the deviation of PPI REERs from 15y averages. Option pricing skew measured as the difference of 1Y at expiry digital call and put option prices (mids). Entries shortlisted have absolute REER mispricing >=10% and option price skewness in the opposite direction to likely mean-reversion by at least 10 % pts. Highlighted entry (AUD/BRL) is one that agrees with current JPM directional views on both legs.

It is used digital options since their prices can be directly interpreted to be the probability of spot ending above/below strike and is comparable across currency pairs; a long (1Y) option expiry is deliberately chosen to match the relatively slow pace of REER mean-reversion; strikes are chosen further out-of-the-money than usual to reflect the magnitude of a potential correction, and strikes of two different money-ness are included for robustness check purposes. The table shortlists entries where the asymmetry of REER valuations (too cheap or too rich) is out of kilter with the extreme lop-sidedness of option pricing (greater than 10% pt. difference between call and put prices) in the opposite direction to that of potential mean-reversion.

For instance, CHF/TRY is 21% too high in REER terms and deserving of a medium-term correction in the direction of weaker CHF/stronger TRY, yet options price CHF strength/ TRY weakness to be far more probable (64% and 80% probabilities of 5% and 10% CHF strength respectively in a year’s time) than symmetric CHF weakness/TRY strength (5% and 2% probabilities of 5% and 10% CHF weakness respectively). Courtesy: JPM

FxWirePro launches Absolute Return Managed Program. For more details, visit:

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Energy Sector Outlook 2025: AI's Role and Market Dynamics

Energy Sector Outlook 2025: AI's Role and Market Dynamics  China's Refining Industry Faces Major Shakeup Amid Challenges

China's Refining Industry Faces Major Shakeup Amid Challenges  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Wall Street Analysts Weigh in on Latest NFP Data

Wall Street Analysts Weigh in on Latest NFP Data  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure