Monetary policy to be more decisive than oil prices. The oil performance has been instrumental in boosting the currency in 2017, even though the long-term picture suggests that the currency has overshot the rebound in oil prices. However, the CAD is on the right track to remain strong: the interest rates factor is taking over from the commodity factor.

Solid growth to push the BoC on the hawkish side. Market pricing is currently similar for the BoC and the Fed, with the probability of two hikes in 2018 slightly above 30%. Indeed, the CAD has been boosted by the BoC's decision to raise rates to 1% in September, earlier than expected, on the back of a brighter-than-expected economic performance. In our view, the market consensus is too gloomy on the drag to the Canadian economy from the housing market.

Valuation suggests upside risks. PPP valuation considerations certainly matter more than in the past. In the commodity currencies bloc, the CAD is close to fair value but the risk of a spike higher is greater for it than for the AUD or even the NZD. In particular, the Australian dollar is largely overvalued, suggesting that short AUDCAD is an attractive valuation-based relative value trade.

Room at the bottom for the USDCAD: The CAD gained 12% against the US dollar during the summer, and this was probably too fast. The recent correction was due, but we expect the Canadian dollar to confirm durable gains over the medium term. The USDCAD hit and bounced at a fresh 1.21 low last September, setting a new horizontal support, which is now quite distant from the current 1.28, leaving downside room.

Options trade recommendations:

AUDUSD: At spot reference: 0.7687, short 2w (1%) OTM put option (position seems good even if the underlying spot goes either sideways or spike mildly), simultaneously, go long in 2 lots of vega long in 2m ATM -0.49 delta put options. A move towards the ATM territory increases the Vega, Gamma, and Delta which boosts premium.

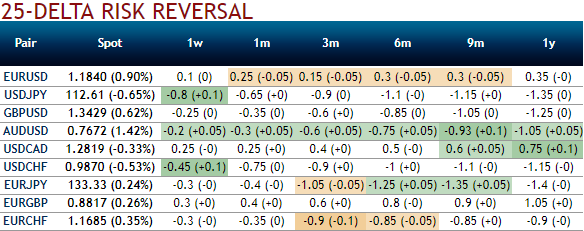

USDCAD: We advocate buying USDCAD 3m risk reversal strikes 1.3440/1.2450 (at spot ref: 1.2757).

The recommended skews and risk reversal structure (refer above nutshells) takes direct advantage of the cheap skew opportunity.

It is expected that any CAD downside to be volatile, as it would likely be caused by geopolitical tensions and/or market unwind. This justifies owning topside convexity and volatility. Pure volatility investors may implement active delta-hedging to get direct exposure to the skew while getting rid of the directional risk. Given the downside risks attached to CAD appreciation, we would advise directional investors to implement a delta-hedging strategy involving a negative pre-defined mark-to-market threshold.

While speculating AUDNZD via DNTs and hedge via options strips looks to be attractive as the ATM IVs have been sluggish. The momentum of underlying spot FX medium-term perspectives is negative following some AU data disappointments. 1.0950 looks vulnerable.

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand

Lithium Market Poised for Recovery Amid Supply Cuts and Rising Demand  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure

Indonesia Surprises Markets with Interest Rate Cut Amid Currency Pressure  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?

U.S. Stocks vs. Bonds: Are Diverging Valuations Signaling a Shift?