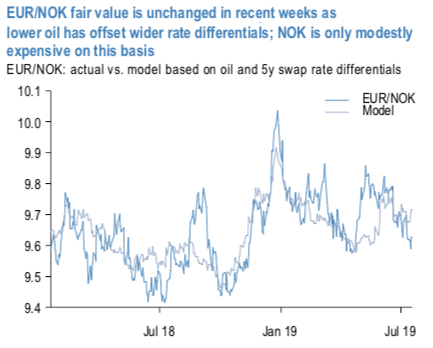

NOK’s lagging performance despite a wider rate differential is explained by crude prices. Assuming usual betas relative to oil, one could argue that EURNOK should have remained range-bound, yet the cross has drifted lower (refer 1st chart). NOK is expensive on this framework, but the magnitude is modest. On longer-term REER-based metrics, NOK is closer to fair value (refer 2nd chart).

SEK remains the cheaper currency among the two on standard frameworks, but valuations alone do not warrant longs in our view. We refer to JPM’s REER model, wherein SEK is the third currency globally and the cheapest in G10 (refer 2nd chart). SEK also continues to appear cheap adjusted for rate spreads, a relationship that has been dislocated for nearly a year now. Nonetheless, we don’t think this warrants long SEK exposure as the Riksbank is likely to be vulnerable to a dovish capitulation as the ECB becomes more dovish, and also since SEK is still among the lowest yielders globally. With the next rate RB hike at least 6 months away, there is little urgency to scale into SEK longs.

Active trade recommendations include long NOK exposure. NOK remains our preferred Scandi FX given a resolute central bank and higher yield and we retain residual exposure to this view in the trade recommendations (via a short in a 1.08 NOKSEK put with 1m left to expiry).

We also re-initiated EURNOK shorts intra-month motivated by a desire to a) increase the magnitude of EUR shorts in our portfolio on of the July 25th ECB meeting, where the balance of risks are skewed towards a more dovish direction in our view, and b) partially reduce the short high beta FX exposure in our portfolio. The risk to a tactically short EURNOK view is its sensitivity to a deterioration in risk sentiment, which is still possible given the soft global growth backdrop.

Medium-term views on both currencies are modestly bullish on gradual rate hikes, which puts them in contrast with other G10 central banks. EURSEK 1- year ahead target is unchanged at 10.45 so a 1% spot strengthening vs. the euro. EURNOK forecast 1-year ahead of the target is also unchanged at 9.60, also a 1% strengthening in spot terms (2.5% in total return terms). Risk bias for both currencies is kept unchanged at bearish given the downside tail risks to global growth and both are high beta currencies. Courtesy: JPM

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Mexico's Undervalued Equity Market Offers Long-Term Investment Potential

Mexico's Undervalued Equity Market Offers Long-Term Investment Potential  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios

Fed May Resume Rate Hikes: BofA Analysts Outline Key Scenarios  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes

Gold Prices Slide as Rate Cut Prospects Diminish; Copper Gains on China Stimulus Hopes  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays