The majority of the Aussie pairs are dragging price dips today on the back of the Chinese domestic demand saw a broad-based easing in April.

AUDUSD dipped -0.20%, EURAUD climbs +0.27%, while AUDJPY slipped about -0.37%, and so is AUDNZD (down by -0.11%).

Advances in retail sales decelerated from 8.7% YoY in Mar to 7.2%, the slowest growth since 2003.

Industrial production and investment fell to 5.4% and 6.1% (YoY YTD) from 8.5% and 6.3%.

We now run you through the focus for antipodeans, of course, is on the central bank meetings that went on last week, in which we expected the first of two consecutive cuts for each central bank, out of which RBNZ has delivered. We still maintain that cutting expectations are justified by the RBA at this juncture, as a combination of household deleveraging, falling home prices and softening inflation is dragging on growth outcomes and raising real rates.

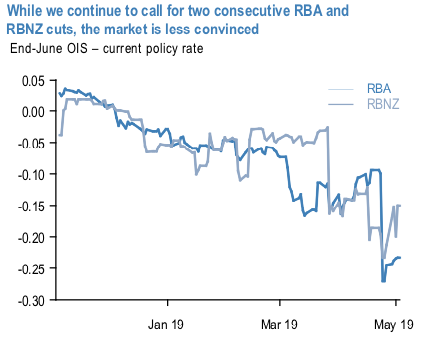

Market pricing suggests lesser conviction, however, as evidenced by some recent equivocation in short-dated OIS rates following the precipitous post-CPI drop from two weeks ago (refer above chart). Market odds of a cut are now just under 50% whereas we believe the proper odds are closer to 70%. This should open up yet further AUD downside if realised.

Benchmarking current expectations from the OIS market against our two-cut forecast by June indicates just how much potential downside there is in AUD rates which should lead to a sizable, one-sided widening in USD-AUD rate spreads given the Fed's dismissal of a near-term insurance cut.

Indeed, should the RBA cut next week, we would expect that to force the market to accept the likelihood of yet another cut and the prospect of a terminal policy rate that is below 1%.

We express this view both against the dollar in cash and against JPY in options encompassing the next two meeting dates – the latter funded by selling a USDJPY put which remains at historically low realized vol. Aside from the RBA deciding to play for time and not cutting next week, the main threat to bearish AUD positions would be from a resolution to the ongoing US-China trade talks.

Nevertheless, AUD is becoming less sensitive to Chinese developments and we would expect this to remain the case in the event of the RBA commencing an independent easing cycle.

Trade recommendations:

Long a 6w 76.75 AUDJPY put, short a 6w 110 USDJPY put. Paid net premium of 25bp at the end of April 25th. Marked at 26bp.

Stay short AUDUSD from 0.7090 March 4th. Marked at 1.28%. Courtesy: JPM

Currency Strength Index: FxWirePro's hourly AUD is flashing at -32 levels (bearish), while hourly JPY spot index is at 45 levels (which is bullish) while articulating at (07:38 GMT).

For more details on the index, please refer below weblink: http://www.fxwirepro.com/currencyindex

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  China Holds Loan Prime Rates Steady in January as Market Expectations Align

China Holds Loan Prime Rates Steady in January as Market Expectations Align  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Trump’s "Shock and Awe" Agenda: Executive Orders from Day One

Trump’s "Shock and Awe" Agenda: Executive Orders from Day One  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Bank of Korea Expected to Hold Interest Rates as Weak Won Limits Policy Easing

Bank of Korea Expected to Hold Interest Rates as Weak Won Limits Policy Easing  Stock Futures Dip as Investors Await Key Payrolls Data

Stock Futures Dip as Investors Await Key Payrolls Data  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook

ECB Signals Steady Interest Rates as Fed Risks Loom Over Outlook  U.S. Urges Japan on Monetary Policy as Yen Volatility Raises Market Concerns

U.S. Urges Japan on Monetary Policy as Yen Volatility Raises Market Concerns  US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts

US Futures Rise as Investors Eye Earnings, Inflation Data, and Wildfire Impacts  Geopolitical Shocks That Could Reshape Financial Markets in 2025

Geopolitical Shocks That Could Reshape Financial Markets in 2025  Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms

Moody's Upgrades Argentina's Credit Rating Amid Economic Reforms