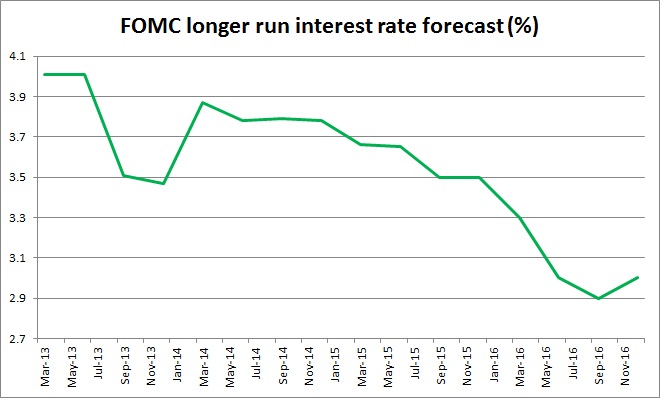

The above chart shows, how the longer run interest rate forecast by the Federal Open Market Committee (FOMC) has evolved since 2013. Last night the Fed announced a hike of 25 basis points in the Federal funds rate and released fresh economic and interest projections. While the future interest rate projections received an upgrade, it is not a uniform one.

- Fed’s interest rate forecast for 2017 rose by 40 basis points, whereas for 2018, it rose by 20 basis points and by 30 basis points for 2019.

- In comparison, the longer run federal funds rate rose by just 10 basis points. However, yesterday’s forecast was the first upgrade in the longer run interest rate projection since March 2014.

Judging from the interest rate forecasts, it would be fair to say that the Fed remains cautious. Back in early 2014, the FOMC was forecasting a longer rate of 4 percent and the current projections are 100 basis points below that and we are three years ahead of that forecast.

We suspect that only a steady return to inflation would make the forecast and the path steeper.

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  New York Fed President John Williams Signals Rate Hold as Economy Seen Strong in 2026

New York Fed President John Williams Signals Rate Hold as Economy Seen Strong in 2026  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says  RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist

RBA Raises Interest Rates by 25 Basis Points as Inflation Pressures Persist  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty