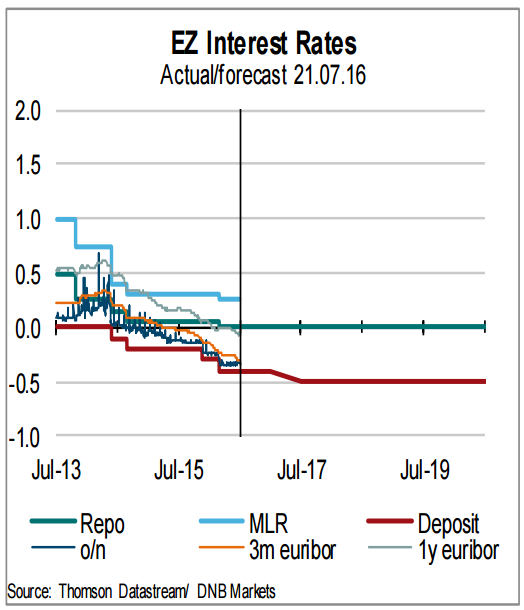

The European Central Bank (ECB) kept its interest rates and forward guidance unchanged as expected on Thursday. The ECB kept its deposit rate at -0.4 percent and the main refinancing rate at 0.00 percent, both record lows, as it seeks to cut borrowing costs for firms and force banks to lend money out rather than park cash with it. It also left its forward guidance unchanged, suggesting that rates would stay at present or lower levels for an extended period.

During his subsequent press conference, ECB president Mario Draghi said the bank will be in a better position to assess the Brexit fallout in coming months but offered the usual caveat that it is ready to act with all its available tools if needed. Market speculation was ripe that the ECB may change the rules in terms of increasing the percentage of peripheral debt it can buy. This follows concerns that the ECB is running out of eligible bonds to purchase on account of the ongoing slump in yields. However, the ECB made no changes to rules governing the QE programme.

"Perhaps, it was the best move because the bank certainly wants to assess the consequences of Brexit which has triggered the need for more QE and dragged the bond yields in negative territory," said Naeem Aslam, chief market analyst at ThinkMarkets UK.

The euro area’s PMIs cooled in July but remained above the 50 level that signals expansion, showing resilience in the immediate aftermath of the Brexit vote. Markit’s flash eurozone composite purchasing managers’ index fell less than expected. Service sector PMI slipped to 52.7 from 52.8, manufacturing PMI fell to 51.9 from 52.0 and composite PMI fell to 52.9 from 53.1. The surveys are among the earliest pieces of evidence available for the ECB's assessment of Brexit’s impact on the economic outlook as it prepares for its September policy meeting.

“Policy makers will be reassured by the resilience of the PMI in the immediate aftermath of the Brexit vote, but the fragility of the recovery leaves plenty of room for speculation about further stimulus later in the year,” said Chris Williamson, chief economist at Markit.

European stocks closed mixed on Thursday, propped up by signals of support for the banking sector from the European Central Bank. UK's benchmark FTSE 100 closed down by 0.3 percent, the pan-European FTSEurofirst 300 ended the day up by 0.04 percent, Germany's Dax ended up by 0.3 percent, France’s CAC finished the day up by 0.1 percent. EUR/USD largely muted on the day, trading around 1.1026 at 10:00 GMT.

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell

Federal Reserve Faces Subpoena Delay Amid Investigation Into Chair Jerome Powell  Stephen Miran Resigns as White House Economic Adviser Amid Federal Reserve Tenure

Stephen Miran Resigns as White House Economic Adviser Amid Federal Reserve Tenure  Bank of Japan Likely to Delay Rate Hike Until July as Economists Eye 1% by September

Bank of Japan Likely to Delay Rate Hike Until July as Economists Eye 1% by September  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  U.S. Stock Futures Edge Lower as Tech and AI Stocks Drag Wall Street Ahead of Key Earnings

U.S. Stock Futures Edge Lower as Tech and AI Stocks Drag Wall Street Ahead of Key Earnings