Chinese economic activity surveys released on Wednesday underpin a scenario of moderate recovery, but a significant rebound is still not evident. All the three reports released today - official manufacturing PMI, non-manufacturing PMI and Caixin manufacturing PMI pointed to economic stabilization, but do not confirm a firm recovery. Weaker April economic data have raised concerns over whether the March bounce is sustainable and suggest PBoC will maintain its accommodative bias.

The official May manufacturing Purchasing Managers' Index (PMI) came in at 50.1, marked the third straight month of expansion (above the 50 mark). Official manufacturing PMI was unchanged from April and a tick higher than a 50 reading expected. China's official non-manufacturing PMI index softened from 53.5 to 53.1 on the back of service sector sub-index, which fell from 52.5 to 52.0. Statistics bureau noted that this was primarily the result of weaker financial sector activity. The construction sector sub-index held steady at a strong 59.4.

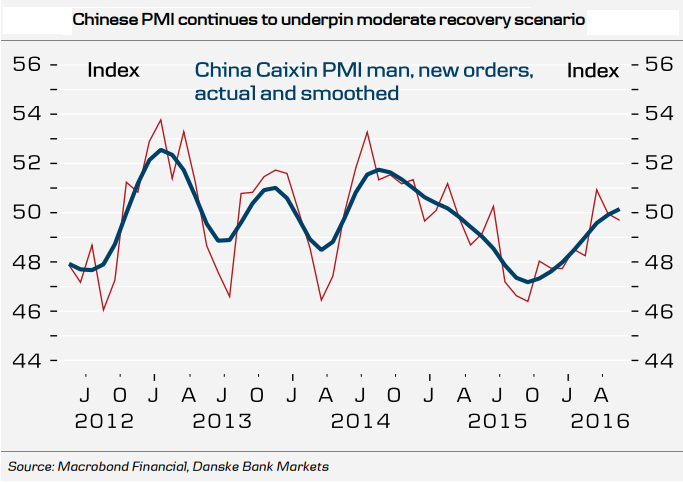

Meanwhile, the Caixin manufacturing PMI index remained in contraction for the 15th consecutive month. Data showed the Caixin manufacturing PMI slipped to 49.2 in May from April's 49.4 reading. It was the lowest figure since February.

"The PMI readings for May were underwhelming. They suggest that activity held up reasonably well last month, but they also offer few signs of improvement," Julian Evans-Pritchard, a China economist at Capital Economics, said in a note Wednesday.

Beijing has been counting on a strong services sector to help offset the prolonged downdraft from manufacturing, and hopes that services will create jobs for some of the millions of factory workers who are expected to lose their jobs as the government tries to cut industrial overcapacity. The services sector is crucial to Beijing's economic evolution to consumer-driven growth so declines in the non-manufacturing PMI index may trigger concern over that transformation.

"We expect PMI to increase moderately in coming quarters as (a) infrastructure spending continues to support activity, (b) construction investments growth rises further and (c) exports find support from improvement in the US and Europe in H2. This should underpin EM assets and give support to metal prices." said Danske Bank in a report.

Most major Asian markets ended lower Wednesday after mixed signals from China's purchasing managers' index (PMI) surveys. The Shanghai Composite ended down 0.08 percent, or 2.41 points, at 2914.21, South Korea's Kospi ended flat, edging down just 0.03 percent and Australia's S&P/ASX 200 ended down 1.03 percent, or 55.36 points, at 5323.20.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?