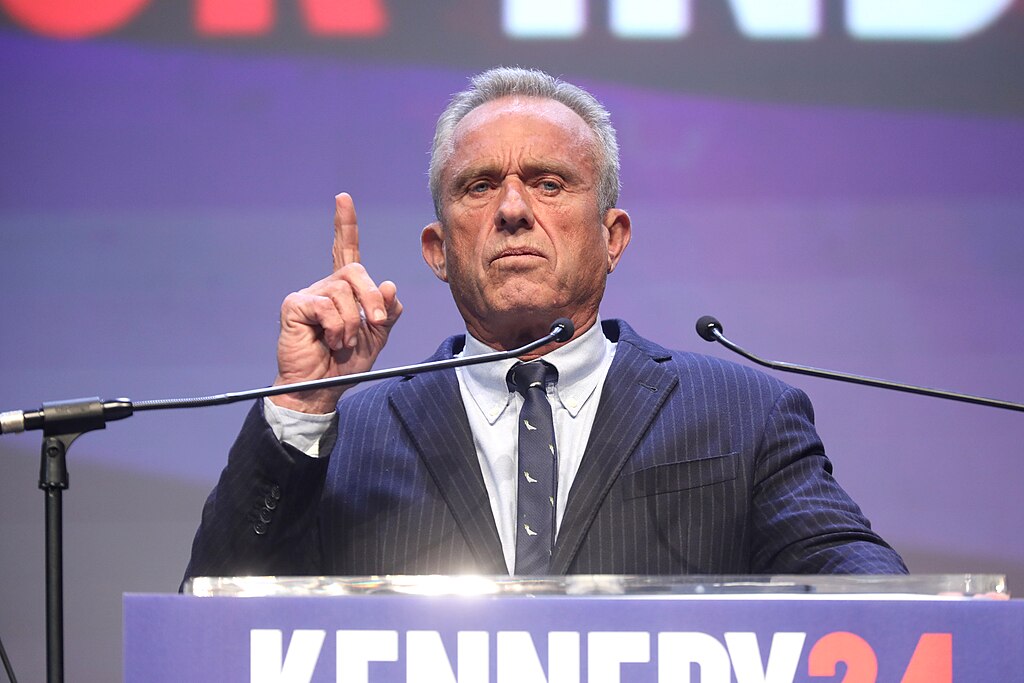

Cantor Fitzgerald analysts are calling for the dismissal of U.S. Health and Human Services Secretary Robert F. Kennedy Jr., citing his controversial anti-vaccine views and lack of scientific expertise. In a note released Monday, Cantor’s Josh Schimmer and Eric Schmidt warned that Kennedy is “undermining the trusted leadership of health care in this country.”

Kennedy recently announced plans to restructure federal health agencies, potentially firing thousands of staff. The move comes on the heels of the resignation of Peter Marks, the FDA’s top vaccine official, who reportedly left under pressure from the administration. Marks had been known for his data-driven approach to vaccine safety and his resistance to what Cantor described as an “anti-science agenda.”

Biotech and vaccine stocks dropped following Marks’ resignation, with the SPDR S&P Biotech ETF (NYSE:XBI) falling 3.9%. Despite the market reaction, Cantor analysts stressed their concerns were about public health, not politics or stock performance.

Cantor Fitzgerald, a major Wall Street firm previously led by Howard Lutnick—now Commerce Secretary under Trump—has recently passed leadership to his sons. Brandon Lutnick now serves as chairman, while Kyle Lutnick holds the position of executive vice chairman.

The analysts expressed hope that Washington leadership will recognize the critical role of vaccines in safeguarding public health. They emphasized the need for scientifically grounded leadership at the Department of Health and Human Services, warning that Kennedy’s conspiracy-driven stance could endanger lives.

Cantor Fitzgerald has yet to comment publicly on the matter.

This development marks a significant flashpoint in the Trump administration’s overhaul of federal health agencies, stirring concern among biotech investors and public health experts alike.

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns  China Overturns Death Sentence of Canadian Robert Schellenberg, Signaling Thaw in Canada-China Relations

China Overturns Death Sentence of Canadian Robert Schellenberg, Signaling Thaw in Canada-China Relations  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Israel Approves West Bank Measures Expanding Settler Land Access

Israel Approves West Bank Measures Expanding Settler Land Access  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Trump Says “Very Good Talks” Underway on Russia-Ukraine War as Peace Efforts Continue

Trump Says “Very Good Talks” Underway on Russia-Ukraine War as Peace Efforts Continue  U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday

U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday  Nicaragua Ends Visa-Free Entry for Cubans, Disrupting Key Migration Route to the U.S.

Nicaragua Ends Visa-Free Entry for Cubans, Disrupting Key Migration Route to the U.S.  American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns  Trump Congratulates Japan’s First Female Prime Minister Sanae Takaichi After Historic Election Victory

Trump Congratulates Japan’s First Female Prime Minister Sanae Takaichi After Historic Election Victory  Ohio Man Indicted for Alleged Threat Against Vice President JD Vance, Faces Additional Federal Charges

Ohio Man Indicted for Alleged Threat Against Vice President JD Vance, Faces Additional Federal Charges  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Samsung Electronics Shares Jump on HBM4 Mass Production Report

Samsung Electronics Shares Jump on HBM4 Mass Production Report  Taiwan Says Moving 40% of Semiconductor Production to the U.S. Is Impossible

Taiwan Says Moving 40% of Semiconductor Production to the U.S. Is Impossible  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Trump Slams Super Bowl Halftime Show Featuring Bad Bunny

Trump Slams Super Bowl Halftime Show Featuring Bad Bunny