North American benchmark, West Texas Intermediate (WTI) is up today and trying to end its biggest consecutive daily decline since 2009. Yesterday, it was up in Asian and early European hours, but later turned negative heading into North American session.

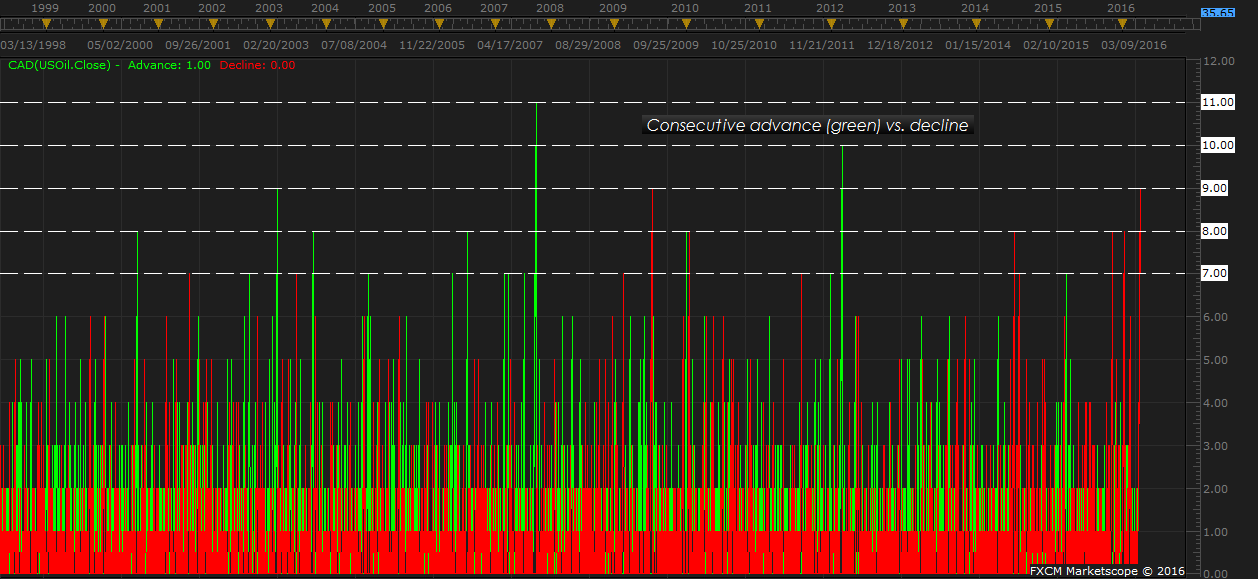

By yesterday, WTI has declined for 9 consecutive days, equivalent to the drop of June/July, 2009. However back then it lost around $15/barrel in those 9 days and this time around it lost little less than half of that.

These long declines are however quite rare, suggesting with every day passing by in red, chances of a bounce back is rising. Since 1999, in past 17 years of trading there has been only two instances, when WTI has declined for 9 consecutive days including the current.

So, will it snap back from here?

Highly likely, but likely also that rally encounters fresh sellers.

There is a minor support around $35.8 area, where it is getting some bids, however further decline by another Dollar at least and more so towards $32/barrel.

WTI is currently trading at $35.6/barrel.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed