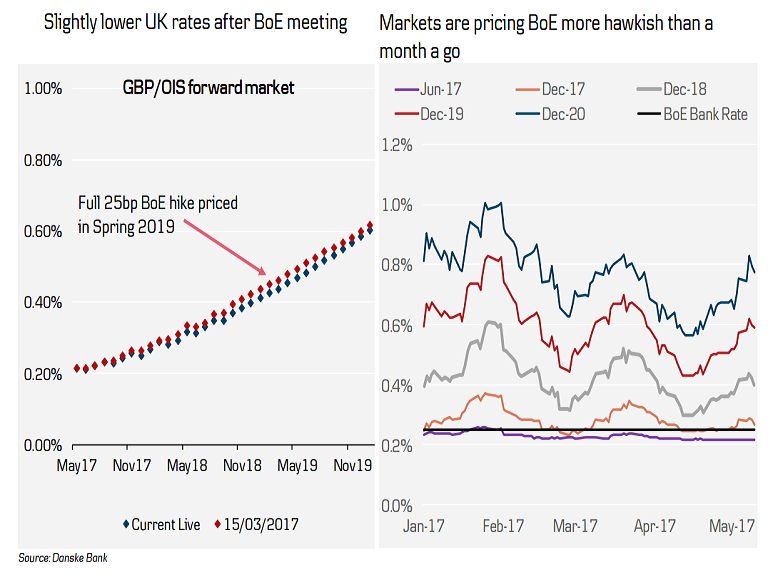

The Bank of England's (BoE) Monetary Policy Committee (MPC) on Thursday voted by a majority of 7-1 votes to leave the bank rate unchanged at 0.25 percent as widely expected by the markets. The central bank also maintained the asset purchase programme at £435bn. Kristin Forbes was again the only member to vote for a hike. The MPC left open the door to further easing if things turn out weaker than anticipated. MPC stated that ‘policy can respond in either direction to changes to the economic outlook as they unfold.'

The BoE has lowered its CPI inflation projections and expects GDP growth of around 1.75 percent in coming years. The projection for the unemployment rate has been lowered as the projection for GDP growth has been lifted. The central bank said that ‘the projected overshoot entirely reflects’ the GBP depreciation and that ‘although domestically generated inflation had been rising, it was currently below the level broadly consistent with the inflation target’. Hence, only a higher domestically generated inflation could act as a trigger for a more hawkish BoE.

The policy statement released thereafter supported the view that, on the assumption of a “smooth” transition to Brexit, monetary policy will likely tighten by a somewhat greater extent than the market is currently pricing-in. The BoE's central projection assumes that, over the near term, the ongoing slowdown in consumer spending will be largely balanced by rising investment and stronger net exports. It also assumes that wage growth will pick up steadily to 3¾ percent Y/Y in 2019.

However, in spite of the modestly hawkish bias of the BoE statement, Pound hits one-week low. GBP came under pressure across the board as market were expecting at least two dissenting votes in favor of higher interest rates on the back of increased inflation pressures triggered by GBP’s post-Brexit depreciation, but Kristin Forbes was again the sole dissenter.

"Given our expectation that GDP and wage growth will be weaker than the BoE expects, and the profound risks relating to the UK’s future relationship with the EU, we continue to forecast that Bank Rate will be left unchanged over the remainder of 2017 and throughout 2018. The direction of policy thereafter will be determined by the outcome of the Brexit negotiations," said Chris Scicluna at Daiwa Capital Markets in a report.

Pound was extending weakness on Friday. GBP/USD was down 0.29 percent at 1.2850, while EUR/GBP was up 0.43 percent at 0.8462 at around 1130 GMT. At the same time FxWirePro's Hourly GBP Spot Index was at -74.6266 (Slightly bearish). For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness