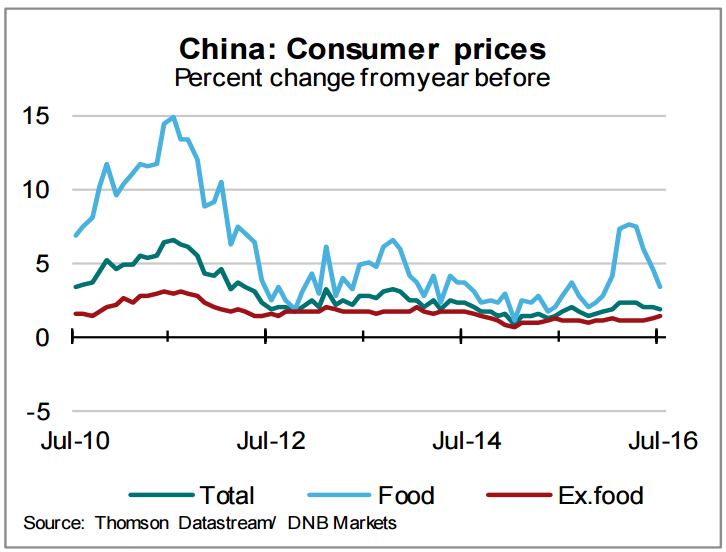

Data released earlier on Tuesday by the National Bureau of Statistics showed that China's CPI inflation came in at 1.8 percent y/y in July, largely in line with market expectations and compared to 1.9 percent in June. On a m/m basis, the CPI rose 0.2 percent in July, after four consecutive months of decline.

Food inflation fell 1.3pp to 3.3 percent y/y. Core-inflation (ex food) was up 0.2pp at 1.4 percent. Overall inflation fell due to lower food inflation, which was due to a drop in vegetable prices. Core inflation (ex-food) looked fairly stable. Vegetable prices, which rose a whopping 20 percent in the first half of the year, decelerated during the peak summer growing season contributing to the drop in the headline number.

China’s Producer Price Index fell 1.7 percent in July from a year earlier, which was a smaller decline than economists expected and compares with a 2.6 percent on-year drop in June. The index has lingered in deflationary territory for more than four years, but the decline has narrowed since the beginning of this year. China’s factory-gate deflation eased for the seventh straight month, signaling improving conditions for the nation’s manufacturers.

"Looking ahead, we expect headline consumer price inflation to begin to edge up again in the coming months. Non-food inflation is set to rise further as the drop in oil prices in the second half of 2015 provides a weaker base for comparison. Meanwhile, flooding in large parts of China last month, which damaged crops and killed livestock, will likely put upward pressure on food inflation in the short-run," said Capital Economics ' China economist Julian Evans-Pritchard.

People's Bank of China policymakers have an inflation target of around 3 percent. Price growth last year was 1.4 percent, a six-year low. Under-target mainland China inflation figure stoked expectations that the PBoC could move more aggressively to stimulus. Also, data released on Monday showed China’s imports fell by more than 12 percent in July, signaling weak domestic demand. And the official purchasing managers’ index in July dipped into contractionary territory for the first time since February.

“These price indicators are very stable compared to before,” said BBVA Research economist Xia Le. “But growth is still anemic. There’s still room for authorities to do more stimulus.”

Asian stocks rose to the highest level in almost a year as commodity producers rallied after Chinese data bolstered optimism that the world’s second-largest economy is stabilizing. China's CSI300 index closed up 0.7 pct at 3,256.98 points while Hong Kong’s Hang Seng index closed down 0.1 pct at 22,465.61 points.

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal