The Bank of Canada is expected to hold steady on interest rates at 0.5 per cent when it meets next week, but rate cut later in 2016 cannot be ruled out. Energy sector remains the BoC’s main concern as rally in oil price is showing first signs of stalling. That suggests the BoC will remain on guard and is likely to remain in dovish mode despite recovery in oil price and despite the expected thrust for growth provided by the new government’s fiscal policy.

BoC last year updated the extraordinary tools it has at its disposal, which include negative interest rates, forward guidance, large-scale asset purchases and funding for credit. The budget released by the new Liberal government earlier this year is also "appropriate" with its spending on infrastructure to boost growth.

“The Bank hopes that fiscal stimulus will provide a lift to the economy, but we doubt the Federal government’s infrastructure plans will make much of a difference in the near term. Accordingly, we still expect the Bank to cut interest rates later this year,” said David Madani at Capital Economics.

In an annual assessment of Canada's economy earlier this month, IMF said that the Bank of Canada's decision to cut rates last year, along with the depreciation of the Canadian dollar, have helped to cushion the effects of cheaper oil, which is a major export for Canada. Although the central bank should consider moving again if necessary, room for additional cuts is limited with rates already at 0.50 percent, the report noted.

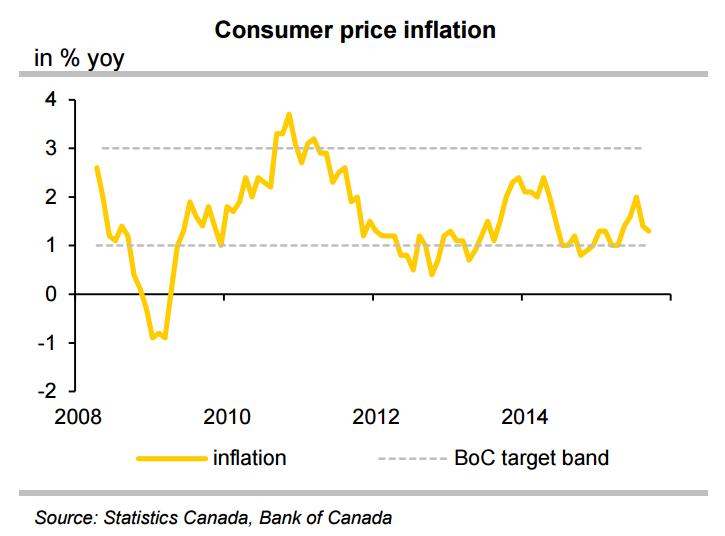

Recent pullback in merchandise exports and manufacturing sales volume data suggests Canada’s industrial sector lost momentum at the close of Q1. Poor data casts some doubt over whether the Canadian dollar’s depreciation did enough to boost growth. At 1.3%, inflation in Canada is currently within the central bank's target band. According to the BoC, the risks for the inflation outlook are balanced. That said, slowdown in economic growth in the coming quarters could change the situation very quickly, especially if this begins to push core inflation lower.

Ahead of the Bank of Canada’s policy decision next week, Canadian inflation data is on the agenda today. Forecasts are for core inflation to ease to 0.1% m/m from 0.7% in the previous month. USD/CAD spot is correcting lower after yesterday’s multi-week peaks in the vicinity of 1.3155. The pair was trading at 1.3117 at 1030 GMT.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate