Indonesia's annual inflation rate increased in February, data from the statistics bureau showed on Wednesday. Indonesia's February annual headline inflation climbed 3.83 percent compared with January's 3.49 percent. The rise was slightly less than the 3.90 percent expected in a Reuters poll.

On a monthly basis, the consumer price index was up 0.23 percent in February. Core inflation which excludes administered and volatile food prices also picked up in February, to 3.41 percent from 3.35 percent in the previous month.

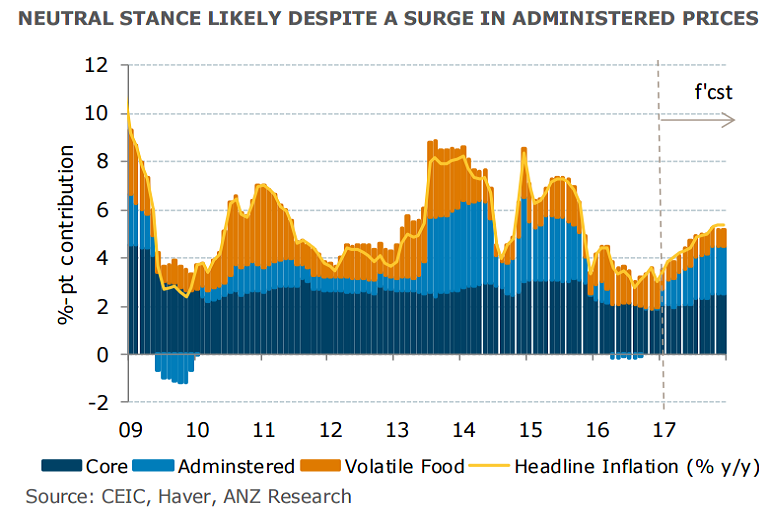

The rise in February inflation was largely driven by increases in electricity tariffs. Higher prices for processed and raw foods as well as healthcare also provided a significant contribution to the rise in annual inflation.

Looking ahead, Indonesia's inflation is likely to rise further as government proceeds to gradually remove electricity tariff subsidies for around 18.7 million recipients. ANZ estimates a further 0.8 percentage point addition to headline inflation from this move.

"We estimate that headline inflation is likely to periodically test the upper bound of Bank Indonesia’s (BI) inflation target in H2 2017. The official forecast corridor of 4% +/- 1% is, however, likely to be respected for the year as a whole," said ANZ in a report.

Indonesia's central bank (BI), which cut its key rate six times in 2016, targets annual inflation to be between 3 and 5 percent during 2017. The central bank's next policy decision is due on March 16th. With expectations for growth on a firmer footing and inflation firmly in check, ANZ expects BI to remain on hold through 2017.

USD/IDR was 0.25 percent higher no the day at 13371 at around 1200 GMT. Short-term trend in the pair is neutral. At the time of writing, FxWirePro's hourly USD strength index was highly bullish at 141.032. For more details on FxWirePro's Currency Strength Index, visit http://www.fxwirepro.com/currencyindex.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated

Bank of England Expected to Hold Interest Rates at 3.75% as Inflation Remains Elevated  Stephen Miran Resigns as White House Economic Adviser Amid Federal Reserve Tenure

Stephen Miran Resigns as White House Economic Adviser Amid Federal Reserve Tenure  Japan Finance Minister Defends PM Takaichi’s Remarks on Weak Yen Benefits

Japan Finance Minister Defends PM Takaichi’s Remarks on Weak Yen Benefits  Asian Currencies Trade Sideways as Dollar Stabilizes, Yen Weakens Ahead of Japan Election

Asian Currencies Trade Sideways as Dollar Stabilizes, Yen Weakens Ahead of Japan Election  Bank of Korea Expected to Hold Interest Rates as Weak Won Limits Policy Easing

Bank of Korea Expected to Hold Interest Rates as Weak Won Limits Policy Easing  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Australia’s Corporate Regulator Urges Pension Funds to Boost Technology Investment as Industry Grows

Australia’s Corporate Regulator Urges Pension Funds to Boost Technology Investment as Industry Grows  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?