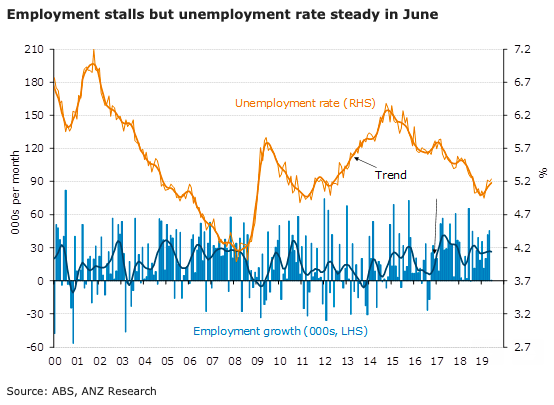

Australia’s unemployment rate remained at 5.2 percent in June, despite flat employment and the participation rate fixing at the record high of 66.0 percent. The temporary boost from election-related jobs reversed in June and a range of indicators has been pointing toward slowing employment growth for some time, according to the latest report from ANZ research.

Employment increased by just 500 workers in June, as the 21.1k gain in full-time employment more than offset the 20.6k fall in part-time employment. After spiking at 2.9 percent y/y on the back of the inflated May result (due to the election), growth fell back to 2.4 percent y/y.

The unemployment rate was unchanged at 5.2 percent despite zero monthly employment growth and the participation rate fixing at the historic peak of 66.0 percent. In a positive sign, the underemployment rate fell 0.4ppt back to 8.2 percent, on the back of the rebound in full-time employment, recovering most of the 0.5ppt rise over the past three months. This brought the total labour market underutilisation rate down to 13.4 percent.

For the first time in years, Western Australia was the standout performer of the states. The 13.8k gain in employment was the largest monthly increase since January 2017 and the unemployment rate consequently fell by 0.5ppt to 5.8 percent, despite a rise in the participation rate.

The other five states recorded falling employment and rising unemployment rates – although NSW managed to maintain its 4.6 percent unemployment rate despite an employment loss of 17.4k.

"The ANZ Labour Market Indicator suggests that employment growth will slow further and that the unemployment rate will stick around the 5.2-5.3 percent mark for the remainder of 2019. Without signs of progress on unemployment, we expect to see further easing by the RBA before year-end," the report further commented.

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom