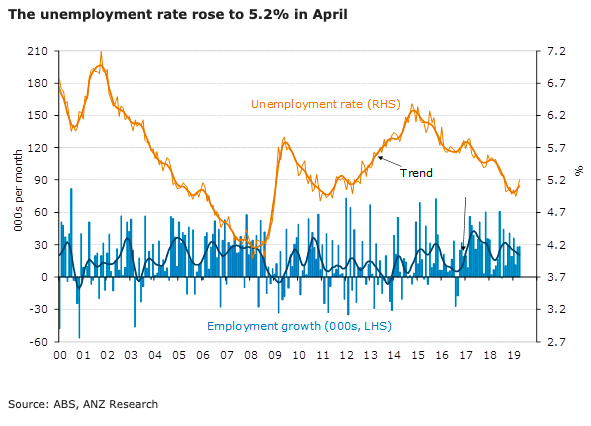

Australia’s unemployment rate moved higher during the month of April despite solid gain in jobs; increased labour supply drove the rise in the unemployment rate, with the participation rate at its highest result on record. The rise could be interpreted as the product of a healthy labour market, according to the latest report from ANZ Research.

Employment increased by 28.4k in April, exceeding the upwardly revised 27.7k in March. In contrast to last month, employment gains in April wholly resulted from a 34.7k rise in part-time jobs. Full-time jobs went backwards by 6.3k, following a strong March figure of 49.2k full-time jobs added.

Year on year, full-time jobs are up 2.9 percent, while part-time employment is up 1.9 percent and total employment accelerated to 2.6 percent.

The unemployment rate was 5.2 percent in April, up 0.3ppt from the low of 4.9 percent in February. The participation rate rose to 65.8 percent, the highest on record (to two decimal places). The underemployment rate jumped from 8.2 percent in March to 8.5 percent in April. So overall slack in the labour market was up quite a bit.

The unemployment rate rose in all states apart from Queensland, which saw a 0.2ppt fall to 5.9 percent. New South Wales (4.5 percent) and Victoria (4.9 percent) maintain the lowest unemployment rates across the states.

"Employment growth is accelerating; moving in the opposite direction from what our ANZ Labour Market Indicator would suggest. However, we see the increased slack in the labour market as a barrier to improving wage growth and inflation," ANZ Research further commented.

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality