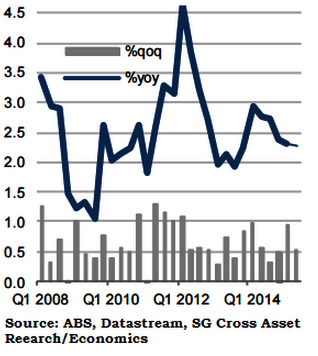

Most components of demand are expected to have grown more strongly or at a similar pace to the first quarter, but overall GDP growth in Australia is expected to have slowed substantially in Q2.

"The reason is that net exports, which have recently accounted for about half of overall growth, are expected to have swung from contributing 0.5pp to quarterly growth in Q1 to zero in Q2. Indeed, the risks are probably skewed slightly to the downside. Imports were slightly down in real terms, but exports also retrace d some of their spectacular increase of 5.0% qoq (not annualised) in Q1", says Societe Generale.

Meanwhile, final domestic demand is expected to have held up fairly well. Judging by retail sales, private consumption probably accelerated slightly, supported by strong employment and growth in real wages. Arguably the most watched component of demand, fixed investment given the steep adjustment in the mining sector, is likely to have expanded, albeit only weakly, thanks to a surge in private sector engineering work related to mining activity.

"This is likely to be only a short-lived interruption of the downward adjustment. Similarly, a pull-back in residential investment is also likely to be a one-off deviation from its rising trend. Lastly, government consumption, notwithstanding all the talk of budget consolidation, is likely to have continued to grow a little below 2% - though public investment remains very weak", anticipates Societe Generale.

All in all, the economy should have expanded at an average annualised pace of 3.0% in the first half, which is in line, or just above, its potential rate.

Australia's economic slowdown as net exports take a breather

Tuesday, September 1, 2015 5:32 AM UTC

Editor's Picks

- Market Data

Most Popular

Copper Prices Hit Record Highs as Metals Rally Gains Momentum on Geopolitical Tensions

Copper Prices Hit Record Highs as Metals Rally Gains Momentum on Geopolitical Tensions  U.S. Eases Venezuela Oil Sanctions to Boost American Investment After Maduro Ouster

U.S. Eases Venezuela Oil Sanctions to Boost American Investment After Maduro Ouster  Asia Stocks Pause as Tech Earnings, Fed Signals, and Dollar Weakness Drive Markets

Asia Stocks Pause as Tech Earnings, Fed Signals, and Dollar Weakness Drive Markets  Wall Street Slips as Tech Stocks Slide on AI Spending Fears and Earnings Concerns

Wall Street Slips as Tech Stocks Slide on AI Spending Fears and Earnings Concerns  Indonesia Stocks Face Fragile Sentiment After MSCI Warning and Market Rout

Indonesia Stocks Face Fragile Sentiment After MSCI Warning and Market Rout  Indonesian Stocks Plunge as MSCI Downgrade Risk Sparks Investor Exodus

Indonesian Stocks Plunge as MSCI Downgrade Risk Sparks Investor Exodus  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Russia Stocks End Flat as MOEX Closes Unchanged Amid Mixed Global Signals

Russia Stocks End Flat as MOEX Closes Unchanged Amid Mixed Global Signals  Oil Prices Hit Four-Month High as Geopolitical Risks and Supply Disruptions Intensify

Oil Prices Hit Four-Month High as Geopolitical Risks and Supply Disruptions Intensify  Asian Stocks Waver as Trump Signals Fed Pick, Shutdown Deal and Tech Earnings Stir Markets

Asian Stocks Waver as Trump Signals Fed Pick, Shutdown Deal and Tech Earnings Stir Markets  Asian Currencies Hold Firm as Dollar Rebounds on Fed Chair Nomination Hopes

Asian Currencies Hold Firm as Dollar Rebounds on Fed Chair Nomination Hopes  China Factory Activity Slips in January as Weak Demand Weighs on Growth Outlook

China Factory Activity Slips in January as Weak Demand Weighs on Growth Outlook