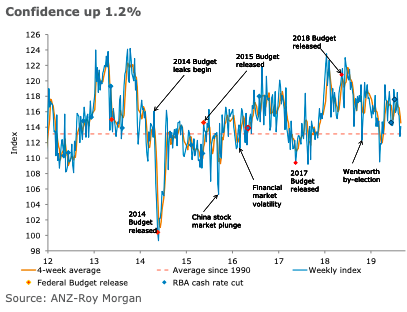

Australia’s ANZ-Roy Morgan consumer confidence gained 1.2 percent last week, pushing the index above its long-term average. Current finances rose by a strong 5.9 percent, taking this measure of sentiment to its highest level since the weekly survey began in 2008.

In contrast, future financial conditions fell 3 percent, reversing the gains of the past two weeks but remaining above average. Economic conditions were also mixed.

Current economic conditions fell 1.4 percent, the fourth consecutive decline, while future economic conditions had a marginal gain of 0.2 percent. Both the indices are below average.

The 'Time to buy a major household item' sub-index gained 4 percent, after falling for three consecutive weeks. The four-week moving average for inflation expectations was stable at 3.9 percent. The weekly reading for inflation expectations jumped to 4.1 percent.

"This week’s gain in consumer confidence is pleasing, considering the news flow around the US-China trade war and the resulting equity weakness. Lower interest rates and taxes are undoubtedly helping. Sentiment toward current finances has gained for three consecutive weeks and has risen to its highest level since weekly surveys began in 2008. This has been sufficient to push overall confidence back above its long-run average. We think the divergence between financial and economic sentiment can be sustained, so long as the labour market remains solid. Also of note is the lift in inflation expectations for the week, to back above 4 percent," said David Plank, ANZ’s Head of Australian Economics.

Russia Stocks End Flat as MOEX Closes Unchanged Amid Mixed Global Signals

Russia Stocks End Flat as MOEX Closes Unchanged Amid Mixed Global Signals  Asian Stocks Waver as Trump Signals Fed Pick, Shutdown Deal and Tech Earnings Stir Markets

Asian Stocks Waver as Trump Signals Fed Pick, Shutdown Deal and Tech Earnings Stir Markets  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  China Home Prices Rise in January as Government Signals Stronger Support for Property Market

China Home Prices Rise in January as Government Signals Stronger Support for Property Market  Dollar Holds Firm as Markets Weigh Warsh-Led Fed and Yen Weakness Ahead of Japan Election

Dollar Holds Firm as Markets Weigh Warsh-Led Fed and Yen Weakness Ahead of Japan Election  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Indonesia Stocks Face Fragile Sentiment After MSCI Warning and Market Rout

Indonesia Stocks Face Fragile Sentiment After MSCI Warning and Market Rout  India Budget 2025 Highlights Manufacturing Push but Falls Short of Market Expectations

India Budget 2025 Highlights Manufacturing Push but Falls Short of Market Expectations  U.S. Stock Futures Slip as Markets Brace for Big Tech Earnings and Key Data

U.S. Stock Futures Slip as Markets Brace for Big Tech Earnings and Key Data