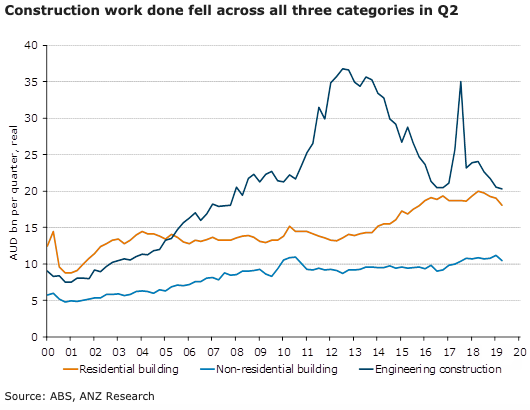

Australia’s construction work done fell for a fourth consecutive quarter in Q2. The contraction in residential activity accelerated, non-residential building activity dropped across both private and public sectors, and the weakness in engineering construction persisted, with only a small uptick in public sector work done, according to the latest report from ANZ Research.

Construction activity in Australia fell 3.8 percent q/q in Q2 2019 to be down 11.1 percent y/y. This was the fourth (and largest) quarterly contraction in a row. The decline in residential construction worsened to -5.1 percent q/q, dragging the annual result down to -9.6 percent. Non-residential building saw an even larger fall of 6.6 percent q/q and engineering construction rounded off the trifecta, down 1.1 percent q/q.

After two quarters of disappointing results, public engineering construction eked out a 0.9 percent gain in Q2. However, it remains 16.1 percent down from the peak a year ago despite the solid pipeline of infrastructure projects. Public non-residential building dropped a further 4.9 percent q/q, following the 2.9 percent fall in Q1.

New building (-5.3 percent) and alterations and additions (-3.3 percent) combined to drag down private residential activity to its lowest level since late 2015. Private engineering construction has not yet bottomed out, falling 2.5 percent q/q, while private non-residential building lost all of the gains from Q1 and then some, down 7.3 percent q/q.

Western Australia (+1.4 percent q/q) was the only state to see a rise in construction, driven by a 2.1 percent q/q increase in engineering construction along with smaller improvements in residential and non-residential building. Queensland (-6.0 percent) recorded the largest decline in construction activity followed by South Australia (-4.8 percent), Victoria (-4.4 percent), Tasmania (-4.1 percent) and New South Wales (-1.9 percent).

"The sharper-than-expected fall in construction activity during the quarter will undermine GDP growth in Q2 2019 and puts downside risk on our pick," the report further commented.

South Korea Exports Surge in January on AI Chip Demand, Marking Fastest Growth in 4.5 Years

South Korea Exports Surge in January on AI Chip Demand, Marking Fastest Growth in 4.5 Years  Russia Stocks End Flat as MOEX Closes Unchanged Amid Mixed Global Signals

Russia Stocks End Flat as MOEX Closes Unchanged Amid Mixed Global Signals  Asian Markets Slide as Silver Volatility, Earnings Season, and Central Bank Meetings Rattle Investors

Asian Markets Slide as Silver Volatility, Earnings Season, and Central Bank Meetings Rattle Investors  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  U.S. Government Faces Brief Shutdown as Congress Delays Funding Deal

U.S. Government Faces Brief Shutdown as Congress Delays Funding Deal  India Budget 2026: Modi Government Eyes Reforms Amid Global Uncertainty and Fiscal Pressures

India Budget 2026: Modi Government Eyes Reforms Amid Global Uncertainty and Fiscal Pressures  U.S. Stock Futures Slip as Markets Brace for Big Tech Earnings and Key Data

U.S. Stock Futures Slip as Markets Brace for Big Tech Earnings and Key Data  Asian Currencies Hold Firm as Dollar Rebounds on Fed Chair Nomination Hopes

Asian Currencies Hold Firm as Dollar Rebounds on Fed Chair Nomination Hopes  UK Employers Plan Moderate Pay Rises as Inflation Pressures Ease but Persist

UK Employers Plan Moderate Pay Rises as Inflation Pressures Ease but Persist  Dollar Holds Firm as Markets Weigh Warsh-Led Fed and Yen Weakness Ahead of Japan Election

Dollar Holds Firm as Markets Weigh Warsh-Led Fed and Yen Weakness Ahead of Japan Election