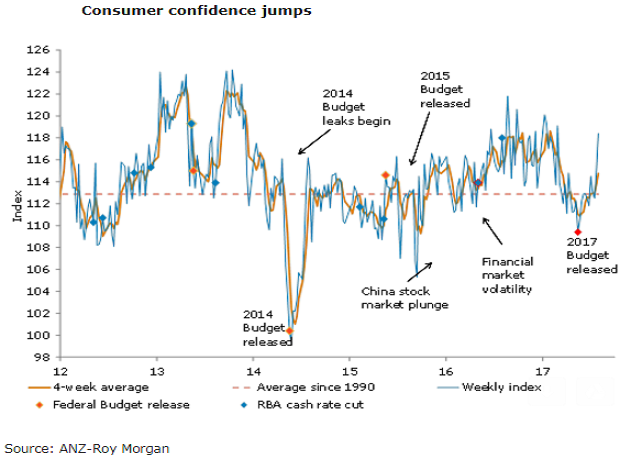

The ANZ-Roy Morgan Australian Consumer Confidence rose for the second straight week (up 2.9 percent) and now sits at its highest point since late February. Despite the jump in the headline index, the details were more mixed, with views towards economic conditions rising sharply but confidence in financial conditions easing a touch.

Households’ views on current and future financial conditions slipped 1.2 percent and 0.9 percent respectively. Both sub-indices remain above or close to their long term averages. Consumers’ views towards current economic conditions shot up 12.3 percent last week, bringing the sub-index to its highest point since September 2013. Views around future economic conditions also rose a solid 8.2 percent, following a 2.7 percent increase in the previous week.

The ‘time to buy a major household item’ rose 0.9 percent last week, following a 1.8 percent rise previously. This sub-index remains well above its long term average. Inflation expectations were unchanged at 4.3 percent on a four-week moving average basis, although the weekly value bounced to 4.4 percent.

"Going forward, it will be interesting to see if the upswing in confidence translates into higher spending. While the two are usually well correlated and recent retail sales data has been positive, we believe that sluggish wage growth, slower growth in house prices and the high level of household debt are likely to remain a drag," said David Plank, Head of Australian Economics, ANZ Research.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data

Gold and Silver Prices Climb in Asian Trade as Markets Eye Key U.S. Economic Data  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data

U.S. Stock Futures Rise as Markets Brace for Jobs and Inflation Data