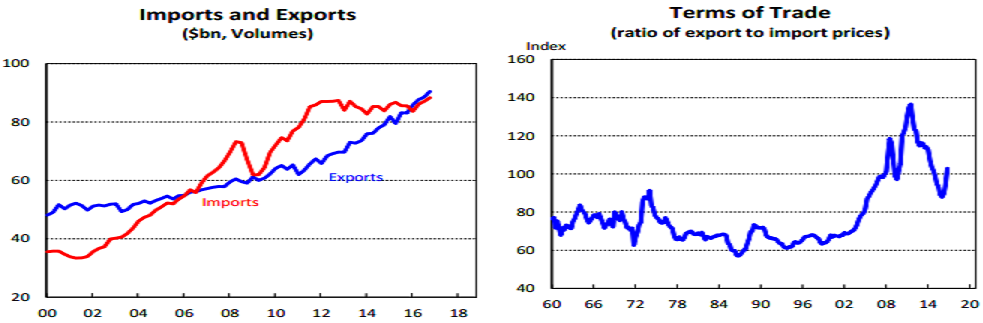

Australia’s current account deficit narrowed significantly, from a revised AUD10.2 billion to AUD3.9 billion, the smallest deficit since 2001. The surge in commodity prices, particularly for iron ore and coal, was largely behind the improvement in the deficit.

The goods and services balance swung into surplus in the December quarter of AUD5.5 billion, after posting an AUD2.8 billion deficit in the September quarter. Export volumes rose 2.2 percent in the December quarter, and have risen for four consecutive quarters. Increased production capacity in resources, particularly in LNG, is driving the strong growth in export volumes.

Import volumes rose 1.4 percent in the December quarter, the third consecutive quarterly increase. On a year ago, imports grew at 3.3 percent. It was a moderate pace, but the strongest in nearly two years. The terms of trade rose 9.1 percent in the December quarter, the biggest gain in 6½ years. The recent lift in commodity prices provides a significant income boost.

Net exports are set to contribute 0.2 percentage points to GDP growth in the December quarter. The range of data, in particular, the strong growth in company profits, would suggest some upside risk to our GDP growth forecast of 0.8 percent in the December quarter and 2.0 percent in the year. This result would confirm that the contraction in the September quarter would be a one-off.

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Australian Household Spending Dips in December as RBA Tightens Policy

Australian Household Spending Dips in December as RBA Tightens Policy  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations

Yen Slides as Japan Election Boosts Fiscal Stimulus Expectations  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election