The Australian economy is into its eighth year of economic expansion and while business confidence is well off its peak, survey indicators are still pointing to solid growth. Firms are optimistic about their own businesses, and still, want to hire and invest. Readings remain elevated.

A net 11 percent of businesses are optimistic about the year ahead. That is unchanged from March and “average”. The sentiment was down in retailing and manufacturing but up in agriculture, construction and the service sector. While headline confidence is “average”, there are few wrinkles across the broader survey; other indicators remain elevated.

A net 38 percent of businesses expect better times for their own business – this indicator tracks growth more closely than headline confidence does. This series has a long-run average of +28. The sentiment is fairly consistent across sectors: the service sector is top at +43 while retailing lags, but is at a more than respectable +29.

Further, investment intentions lifted from +21 to +24 (average 13). Employment intentions remain strong. A net +22 (average 9) of firms are looking at hiring more staff, down 1 point. All sectors bar agriculture are expecting to lift employment.

Profit expectations lifted from +23 to +26 (average 10), led by increases for the construction and retail sectors. Export intentions eased from +30 to +24, undoing much of March’s rise. Residential construction intentions lifted from +25 to +33. Commercial construction intentions rose to +35 from +23.

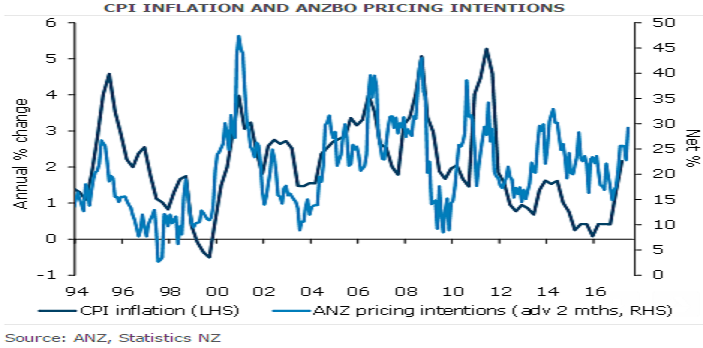

Firms’ pricing intentions lifted from +23 to +29. Inflation expectations were unchanged at 1.8 percent. A net 30 percent of businesses expect it to be tougher to get credit in 12 months’ time. It’s universal across all sectors but led particularly by agriculture.

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed