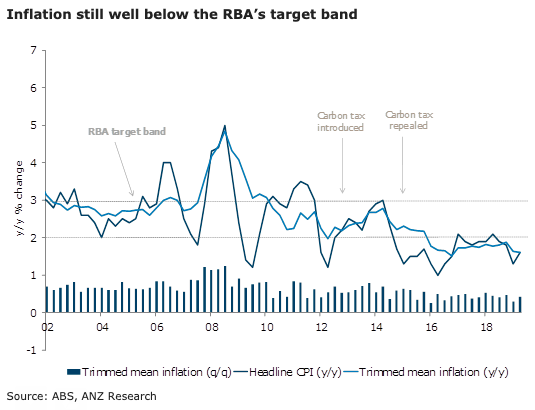

Australia’s headline inflation for the second quarter of this year rebounded after being flat in Q1. In annual terms, it increased to 1.6 percent (from 1.3 percent in Q1). The largest positive contributions for the quarter came from fuel prices rising 10.2 percent, international holiday travel and accommodation increasing by 2.7 percent and tobacco prices rising 2.4 percent.

Partly damping these increases were fruit and vegetables prices falling 2.8 percent and electricity prices coming off 1.7 percent.

Importantly, trimmed mean inflation, the measure of inflation most focused on by the RBA, increased 0.4 percent q/q. This saw the annual number unchanged at 1.6 percent. The RBA in its May SoMP forecast inflation to be 1.6 percent by June 2019.

So although 1.6 percent is below its inflation target, this print does not put pressure on the Bank to cut interest rates quickly again and allows it the room to see how future data play out.

Although trimmed mean inflation picked up this quarter, the ANZ Diffusion Index (which measures the proportion of the basket with annualised price rises of 2.5 percent or more) fell to 34 percent from 44 percent in Q1.

"The RBA’s forecasts to be published in the Statement on Monetary Policy next week will assume two further rate cuts (reflecting current market pricing). It is very difficult to see how the Bank will achieve its target of 4.5 percent unemployment in a timely manner without further easing. Consequently, we continue to expect another cut in the next few months, the exact timing of which we will firm up after next week’s RBA statement," ANZ Research commented in its latest report.

Oil Prices Slide Nearly 3% as U.S.-Iran Talks Ease Geopolitical Tensions

Oil Prices Slide Nearly 3% as U.S.-Iran Talks Ease Geopolitical Tensions  Gold and Silver Prices Plunge as Trump Taps Kevin Warsh for Fed Chair

Gold and Silver Prices Plunge as Trump Taps Kevin Warsh for Fed Chair  South Korea Factory Activity Hits 18-Month High as Export Demand Surges

South Korea Factory Activity Hits 18-Month High as Export Demand Surges  India Budget 2026: Modi Government Eyes Reforms Amid Global Uncertainty and Fiscal Pressures

India Budget 2026: Modi Government Eyes Reforms Amid Global Uncertainty and Fiscal Pressures  China Home Prices Rise in January as Government Signals Stronger Support for Property Market

China Home Prices Rise in January as Government Signals Stronger Support for Property Market  Wall Street Slides as Warsh Fed Nomination, Hot Inflation, and Precious Metals Rout Shake Markets

Wall Street Slides as Warsh Fed Nomination, Hot Inflation, and Precious Metals Rout Shake Markets  U.S. Eases Venezuela Oil Sanctions to Boost American Investment After Maduro Ouster

U.S. Eases Venezuela Oil Sanctions to Boost American Investment After Maduro Ouster  Gold Prices Stabilize in Asian Trade After Sharp Weekly Losses Amid Fed Uncertainty

Gold Prices Stabilize in Asian Trade After Sharp Weekly Losses Amid Fed Uncertainty