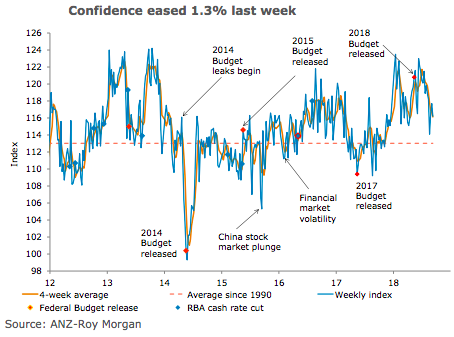

Australia’s ANZ-Roy Morgan consumer confidence eased 1.3 percent last week, after two straight weekly rises. Improvements in sentiment toward future finances and current economic conditions were not strong enough to offset falls in the remaining sub-indices.

Households’ perception of current financial conditions fell 4.8 percent last week, more than reversing a cumulative 1.7 percent gain over the previous two weeks. Meanwhile, sentiment towards future financial conditions rose 2.1 percent, its third straight weekly increase.

Encouragingly, households’ assessment of current economic conditions bounced 2.1 percent, entirely reversing the prior week’s fall. Consumers were less optimistic about future economic conditions, however. Their assessment fell 3.5 percent to 111.5 (versus a long term average of 113.9).

The 'time to buy a household item' sub-index fell 2.3 percent last week, only partially reversing the sharp 5.2 percent rise in the prior week. Four-week moving average inflation expectations were unchanged at 4.3 percent, though the weekly value dipped to 4.1 percent.

"We expect a solid jobs report on Thursday, which should provide some support for confidence in the near term. That said, geopolitical developments continue to evolve and have the potential to weigh on the outlook of consumers," said David Plank, Head of Australian Economics, ANZ Research.

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals