Federal Open Market Committee (FOMC) will announce monetary policy decisions today at 19:00 GMT at the end of its two-day monetary policy meeting. It is widely expected that the FOMC members would vote to hike rates by 25 basis points at today’s announcement.

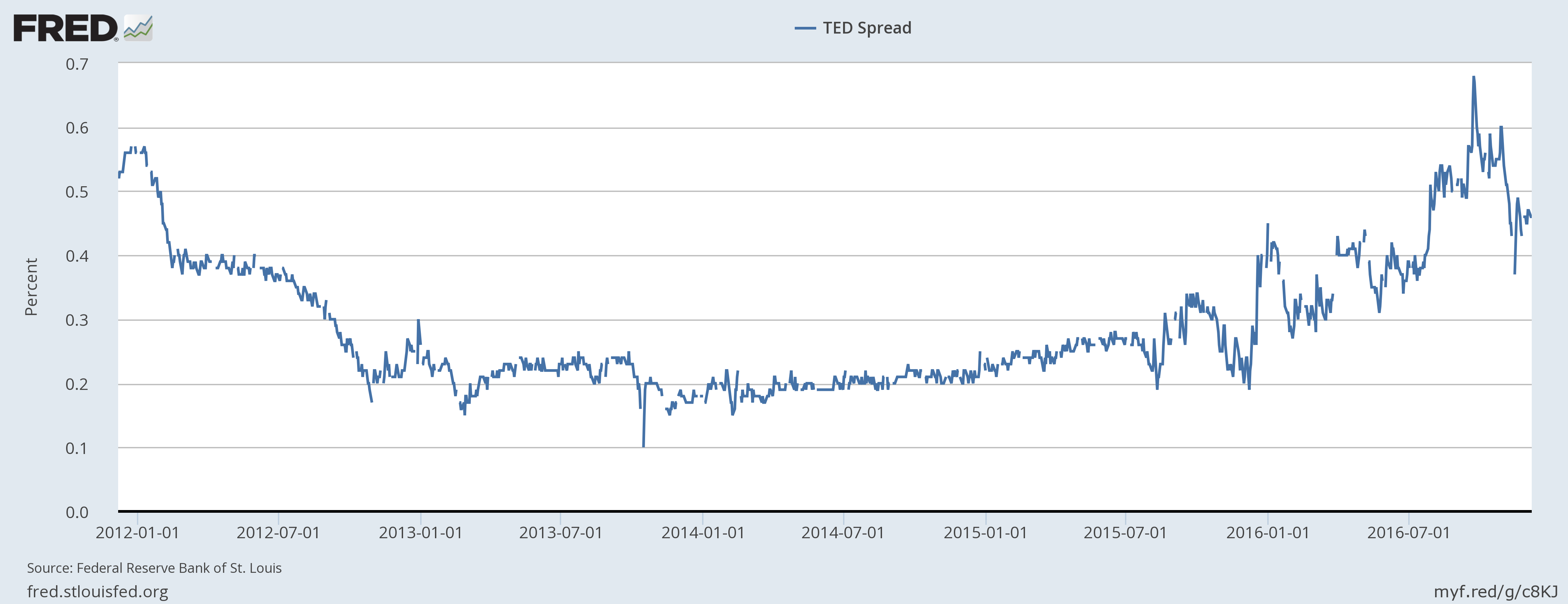

We, at FxWirePro, would keep a close watch over the next few days on the TED spread along with some other instruments. TED spread is the difference between the yield on 3-month Treasury bill and rates on interbank loans, which is represented by London Interbank Offered Rate (LIBOR). LIBOR bottomed in 2014 around 0.22 percent and jumped sharply from 0.32 percent to 0.61 percent in late 2015. After consolidating through the early half of the year, 3-month USD LIBOR started rising from 0.62 percent in July to 0.96 percent as of now, which is the highest level since the 2008/09 crisis. Similar rise happened last year before the Fed hike of 25 basis points in December, if that is the case then there is little to worry other than the higher interest rates. But if LIBOR continues to rise along with the TED spread, which can be read as the market demanded risk premium for holding loans other than the secured treasuries, it could point to funding shortage in the market along with the rise in the risk perception.

We don’t suspect that being the case, especially since the TED spread after reaching 0.68 percent in September, the highest level since May 2009 has declined to 0.45 percent. We suspect that the treasuries have been late to react to the possibility of a hike. Nevertheless, the spread demands a close scrutiny after the Fed over next couple of weeks.

Bank of Japan Likely to Delay Rate Hike Until July as Economists Eye 1% by September

Bank of Japan Likely to Delay Rate Hike Until July as Economists Eye 1% by September  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  US-India Trade Bombshell: Tariffs Slashed to 18% — Rupee Soars, Sensex Explodes

US-India Trade Bombshell: Tariffs Slashed to 18% — Rupee Soars, Sensex Explodes  Indian Rupee Strengthens Sharply After U.S.-India Trade Deal Announcement

Indian Rupee Strengthens Sharply After U.S.-India Trade Deal Announcement  U.S. Stock Futures Rise as Investors Eye Big Tech Earnings and AI Momentum

U.S. Stock Futures Rise as Investors Eye Big Tech Earnings and AI Momentum  Stephen Miran Resigns as White House Economic Adviser Amid Federal Reserve Tenure

Stephen Miran Resigns as White House Economic Adviser Amid Federal Reserve Tenure  ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence

ECB’s Cipollone Backs Digital Euro as Europe Pushes for Payment System Independence  Japan Finance Minister Defends PM Takaichi’s Remarks on Weak Yen Benefits

Japan Finance Minister Defends PM Takaichi’s Remarks on Weak Yen Benefits  New York Fed President John Williams Signals Rate Hold as Economy Seen Strong in 2026

New York Fed President John Williams Signals Rate Hold as Economy Seen Strong in 2026  Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons