WTI is trading at key resistance area at $44.9/barrel. Rising steadily after initial jolt from talks failure at Doha among producers to freeze production.

Key factors at play in Crude market –

- Oil largely ignored talks failure at Doha, among international producers to freeze production at January’s level and now WTI is touching into new highs of 2016.

- Saudi Prince Mohammad bin Salman, who is Kingdom’s new strongman has laid out a plan to diversify Saudi Arabia from oil. Plan is named Saudi Vision 2030. It will increase non-oil revenue to Real 1 trillion by 2030 from current 163 billion.

- Barclays and Goldman Sachs have warned that recent commodities rally isn’t riding on fundamental improvements and it could easily deteriorate if investors rush for exit.

- IEA in its latest report cited freeze initiative and weaker Dollar behind oil rally suggested that price may have bottomed.

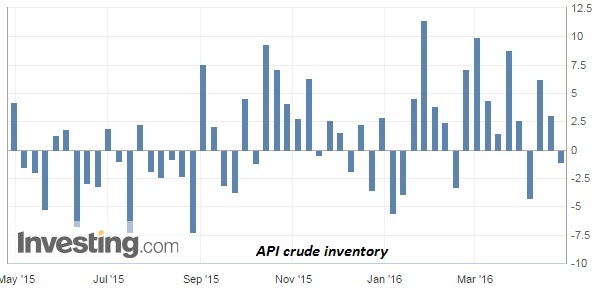

- American Petroleum Institute’s (API) weekly report showed inventory decline by 1.07 million barrels.

Today’s inventory report from US Energy Information Administration (EIA), to be released at 14:30 GMT.

Chart courtesy investing.com

Trade idea –

- WTI is gaining sharply against all odds and warnings, however this doesn’t looks to be a prolonged recovery but initial jitters from Dollar weakness and short covering.

- In terms of trading, it is advised to stay in the sidelines.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX