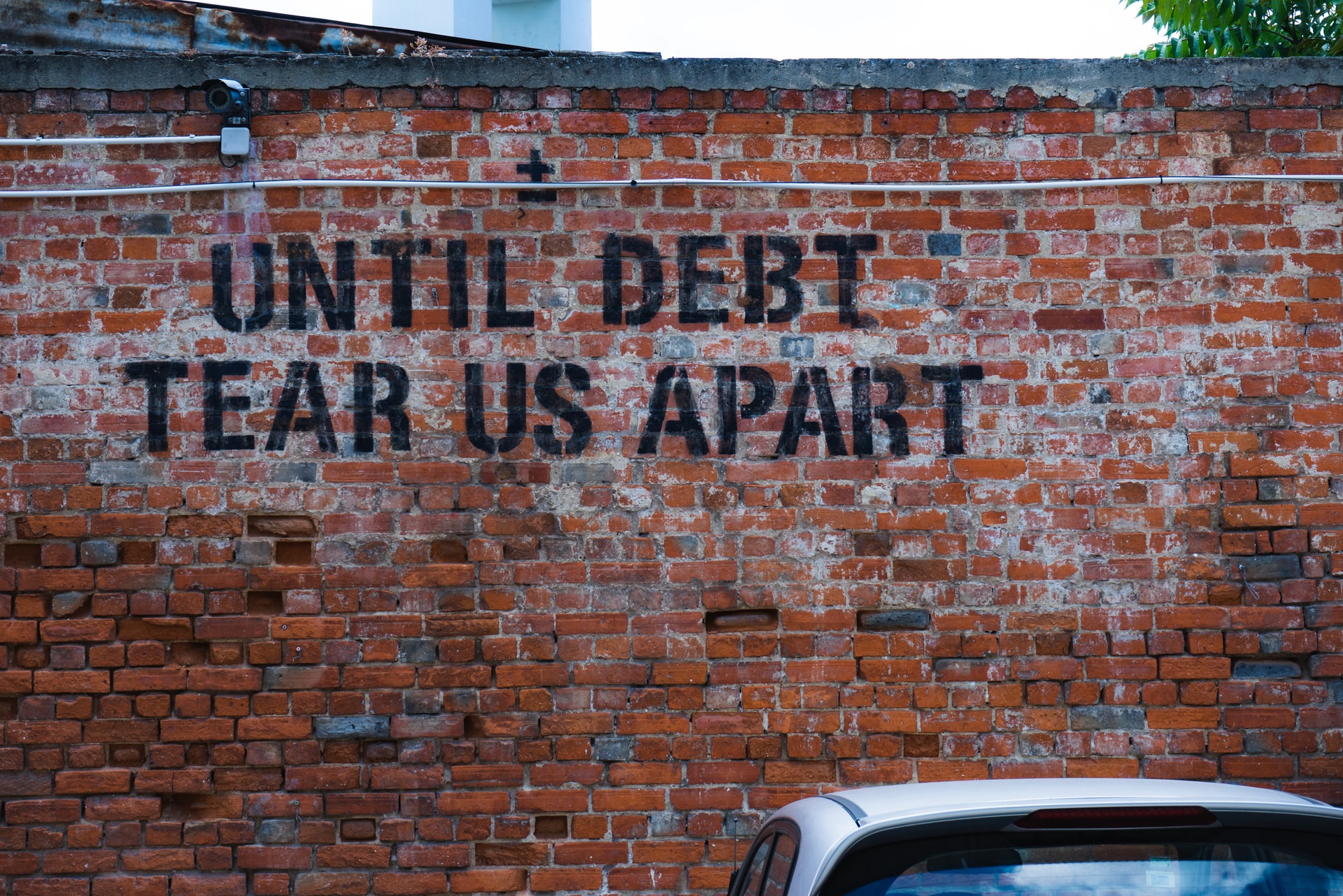

It’s highly likely that you have had some sort of consumer debt before and it doesn’t have to be a huge amount; it can be something small, if you came out of it, lucky for you. However, many people are stuck in debt as it has the capacity to get bigger if not checked. As you read these articles, you will learn some essential things about debt, such as: What is debt, The pitfalls of debt, The type of debt you should be wary of, etc.

What is Debt?

The words loan and debt have basically the same meaning, and they can be used interchangeably. There is a good debt in some cases, like a business taking out a loan. However, if you’re a fan of semantics, a loan is the specific amount a person owns, while debt is the total amount of loans that are outstanding. For example, if Samuel took three loans that are worth $5,000 each, that’ll mean that he has a total debt of $15,000.

What Is Bankruptcy and what is a Chapter 13 Calculator?

An individual may file bankruptcy when he/she has too much debt. Bankruptcy is a legal debt relief option that allows you to discharge debt when that debt is no longer affordable, generally when someone experiences a financial hardship.

The two most common consumer bankruptcies in the United States are Chapter 7 and Chapter 13 bankruptcy. Chapter 7 is often a much faster bankruptcy while Chapter 13 bankruptcy requires a plan payment. In this case, you may consider using a Chapter 13 calculator to help estimate your Chapter 13 plan payment.

1. Let’s get back to Debt. Debt is about risk

Debt by nature is highly intertwined with perceived risk. That’s confusing? Let’s break it down.

Assuming you have a sister called Mary, and she wants to borrow $500 to pay a security deposit on her new apartment in California because she recently got a promotion and was asked to move there. Also, your brother Philip needs $500 to pay his rent that’s already due. And he can’t approach credit issuing agencies because he already has non-performing loans with them due to the days he spent in prison.

If you plan to get your money back, who would you issue the loan to? Definitely Mary

Let’s now assume that you’re a bank, who is ordinarily empowered to sell and buy loans. You’ll charge every borrower interest on loan, and you’ll require that it’s paid monthly. The interest is often a percentage of the loan amount.

Both Mary and Philip applied for a loan. Will you issue both Philip and Mary the same interest rate? You definitely won’t. Philip will have to pay more because the probability is high that he’ll not payback. Thus Philip will get more interest than Mary because his perceived risk is high.

2. Features of a Loan

Secured vs Unsecured Debt

Now that you have a better knowledge of risk, let’s flashback to the scenario of your brother Philip. You feel that the risk is too high, and you turn his loan request down. But he’s pretty desperate for the loan, and he offers you his car as collateral if he doesn’t pay back as agreed. Since the loan is backed up by something of value, which will decrease your chances of not getting the money back, you’ll likely give him the loan. As a matter of fact, you’ll probably charge very little interest if the value of the car is higher than the loan. In this instance, the debt is now a secured loan because it’s guaranteed by something of value.

Secured loans are of different types, and you’re probably in one without knowing. Auto loans use your car as collateral; home mortgages use your house as collateral—they are both secured loans.

Vividly, secured loans are generally less risky for lenders than loans that are unsecured. Thus, you’ll probably be getting a much-reduced interest rate on your secured loans. Due to the fact that the only collateral that a creditor has on an unsecured loan is your credit score, they are often pickier and charge a higher interest rate.

Caution: Be careful of deals that involve trading your unsecured loans for a secured loan. It’s a deal that only pays the creditor and would probably make you lose your asset.

3. Variable vs Fixed Interest Rate

When you approach a bank for a loan, they’ll issue you the loan at an interest rate that adjusts with their whims or market value or issue you one that’ll remain constant throughout the lifespan of the loan.

Obviously, a fixed rate will be a much better option as you’ll know what you’ll pay monthly. But even at that, many people still prefer a loan with interest that varies because it’s often lesser than fixed rates.

However, a common trap you should watch out for is the capacity of variable interest loans to fluctuate wildly. You may agree to a mortgage loan when the rate is within reach and can find it difficult to pay when the interest rate rises. And in such instances, your creditor may take control of the property if it’s a mortgage loan.

4. Payment Schedule

Lenders will help you calculate your payment schedule and give you a copy of it. You’ll be required to pay a portion of what you borrowed and the outstanding interest on a monthly basis. This is called “Minimum Payment” for credit cards and “Mortgage Payment for home loans. The details of the time to pay your bills will be clearly displayed for you.

However, be careful for credit card minimum payments as they’re often calculated to only cover a small portion of your outstanding loan. This way, you’re guaranteed to pay for a long time, and that will help them maximize their earnings. It becomes more complicated if your lender charges you interest monthly, then you’ll pay that debt till you die.

5. Credit Limit

Generally, lenders would calculate the loan sum they think you can handle in total. To do this, they’ll consider your salary, your expenditures, and your current total existing debt.

If you’re approved for a line of credit by a lender, you will have a credit limit—this is the total number of debt you can take; beyond this limit, the lender will not issue you the loan. If you’re using a credit card, your card transaction will be declined when you attempt to spend beyond this limit.

6. Good Debt VS Bad Debt

It’s not a terrible idea to have debt, although every debt has its own risk. In this section, you’ll see a breakdown of why people enter debt, and we’ll let you know if such decisions are good or not.

a) Leveraging

This is an act of increasing your profit by using a loan. For example, you can purchase a home for about $100,000 and rent the apartment out at $1,000 monthly. This will sum up to $12,000 annually. That’ll sum up to a profit of 12% ROI yearly. And you’ll make a higher amount of money if you keep borrowing money and using it to build a house for rent, then that’ll be a smart financial move.

b) Lifestyle

This might sound funny, but some people actually incur credit card debt for vacation or to sustain a lifestyle that’s out of their league. This is not recommended as it’s one of the easiest ways to be trapped in debt without getting anything worthwhile from it.

c) Existing Debt

It’s often common to see people seeking a loan to pay off existing debt, and it can be a smart choice. For example, if you have a credit card debt of $5,000, that has an interest rate of %25 per year. It’s a smart choice to take a personal loan at 8% per year to clear off your credit card debt. This is a called debt consolidation, and it has its pros and cons. With this method, the aim is to find a loan with better terms than your initial loan and use the new loan to replace the initial one. If you’re desperate to reduce the interest you pay on loan, then this is a much viable option. However, the disadvantage is that you’ll pay the debt for longer period than necessary.

Sometimes debt can be too much to handle so there are debt relief options put in place to help combat that. There is bankruptcy which can be used for more serious situations, so it’s important to checkout the pros and cons of bankruptcy. If bankruptcy is the right option, taking a chapter 13 calculator can help you make the right decision. Sometimes if you fall back into debt after filing for bankruptcy before, you can file chapter 13 after chapter 7, if chapter 7 is what you filed for the first time around.

Conclusion

Your financial well-being is tied to your understanding of debt and other financial matters. Although debt can be used positively, the aim should be to exit it and be completely debt-free. If you’re looking for ways to achieve that financial freedom you desire, then you should use this online financial planner.

This article does not necessarily reflect the opinions of the editors or management of EconoTimes

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns

American Airlines CEO to Meet Pilots Union Amid Storm Response and Financial Concerns  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing

Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports