Germany’s economic performance has been the driving force of the euro area’s recovery so far, and upbeat business confidence in October suggests that the German economy is on track for more robust growth. Brexit vote had temporarily unsettled companies in Germany, but recent data show signs of upward trend.

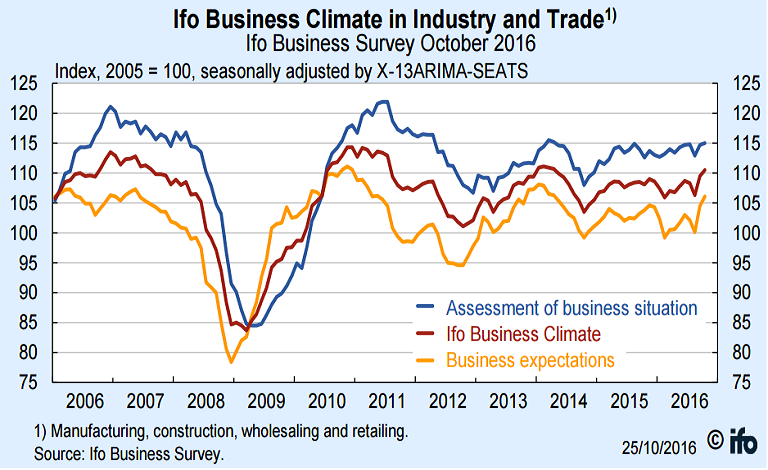

Data released on Tuesday by the Munich-based Ifo institute, showed that German business confidence in October improved to the highest level since April 2014, signalling uncertainty over Brexit continued to abate. German business climate index climbed to 110.5 from 109.5 in September, Business Expectations Index rose to 106.1 from 104.5 and Current Assessment Index increased to 115.0 from 114.7.

German GDP data is due on Nov. 15 and economists surveyed by Bloomberg expect Q3 GDP growth of 0.3 percent after 0.4 percent in the previous three months. However, the Bundesbank in its 'Monthly Report' released on Monday, has dismissed weaker growth in Q3 as temporary and said that underlying momentum remains strong. Export and business expectations in manufacturing suggest the situation could improve in the coming month, the central bank added.

Latest German data overall has also suggested a significant improvement at the start of the fourth quarter. The latest German PMI data, released on Monday, showed a strengthening in the manufacturing sector to a 33-month high and a notable recovery in the services sector. German out-performance would certainly complicate ECB policy making and Bundesbank opposition to an extension of bond purchases would tend to intensify.

While Germany’s economy may be headed for a pick-up, data suggest that the rest of Europe will continue expanding at a slower pace. Separate report released by official statistics office INSEE on Tuesday showed that France manufacturing confidence dropped slightly to 102 in October from 103.

"In Germany, growth may even have accelerated toward the end of the year. With other parts of the eurozone, particularly France and Italy, performing far worse than their larger neighbor, the ECB will remain under pressure to offer more policy support to achieve its region-wide inflation goal,” said Jennifer McKeown, chief European economist at Capital Economics.

EUR/USD largely muted on upbeat German Ifo data. The pair was 0.04 percent lower, trading at 1.0875 at around 12:00 GMT.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says

RBA Expected to Raise Interest Rates by 25 Basis Points in February, ANZ Forecast Says