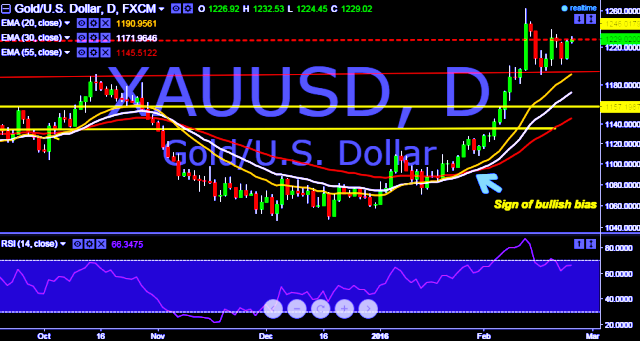

- Pair is currently trading at $1228 levels.

- It made intraday high at $1232 levels and low at $1224 marks.

- Pair is trading range bound from $1190 to $1240 mark.

- Intraday bias remains bullish above till the time pair holds key support level at $1200 levels.

- Alternatively, a daily close below $1195 mark will turn the bias bearish again.

- Major support levels are seen at $1222, $1218 and $1207 thereafter.

- Key resistance levels are seen at $1242, $1252 and $1268 levels.

We prefer to take long position in XAU/USD around $1227, Stop loss $1218 and target $1252 levels.