The United States and China have finalized a long-anticipated trade agreement that was initially reached in Geneva last month, according to U.S. Commerce Secretary Howard Lutnick. Speaking with Bloomberg Television, Lutnick confirmed, “That deal was signed and sealed two days ago,” though he did not share further details about its contents.

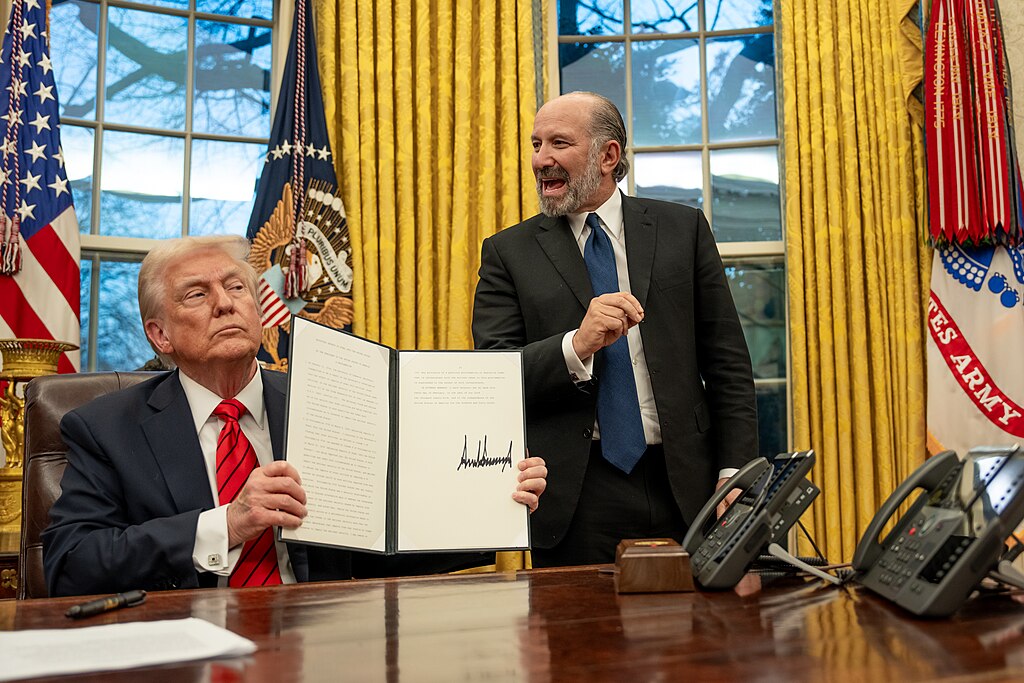

President Donald Trump also referenced the agreement during a White House event, stating, “We just signed with China yesterday,” without offering additional clarification. The deal is expected to significantly impact global supply chains and bilateral economic ties between the world’s two largest economies.

A key provision in the agreement includes China supplying rare earth materials—essential components for advanced electronics and defense technologies—to the United States. In exchange, the U.S. will lift existing restrictions on ethane exports to China, opening new energy trade channels.

Trump initially announced progress on the deal on June 11 via Truth Social, writing, “Our deal with China is done, subject to final approval with President Xi and me. Full magnets and any necessary rare earths will be supplied, up front, by China. Likewise, we will provide to China what was agreed to... We are getting a total of 55% tariffs, China is getting 10%.”

Lutnick also noted that the U.S. is nearing a separate trade agreement with India, signaling a broader strategy to secure critical resources and improve trade balances.

The U.S.-China deal marks a significant development in the evolving trade relationship between the two nations, especially amid growing global demand for rare earth elements and energy resources. It reflects renewed efforts to stabilize economic cooperation while addressing strategic resource dependencies.

Trump Says “Very Good Talks” Underway on Russia-Ukraine War as Peace Efforts Continue

Trump Says “Very Good Talks” Underway on Russia-Ukraine War as Peace Efforts Continue  Federal Judge Restores Funding for Gateway Rail Tunnel Project

Federal Judge Restores Funding for Gateway Rail Tunnel Project  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Iran–U.S. Nuclear Talks in Oman Face Major Hurdles Amid Rising Regional Tensions

Iran–U.S. Nuclear Talks in Oman Face Major Hurdles Amid Rising Regional Tensions  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Netanyahu to Meet Trump in Washington as Iran Nuclear Talks Intensify

Netanyahu to Meet Trump in Washington as Iran Nuclear Talks Intensify  Nighttime Shelling Causes Serious Damage in Russia’s Belgorod Region Near Ukraine Border

Nighttime Shelling Causes Serious Damage in Russia’s Belgorod Region Near Ukraine Border  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  US Pushes Ukraine-Russia Peace Talks Before Summer Amid Escalating Attacks

US Pushes Ukraine-Russia Peace Talks Before Summer Amid Escalating Attacks  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape