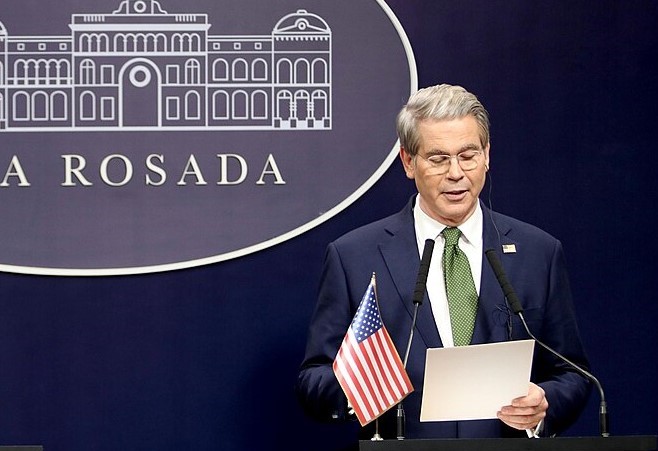

U.S. Treasury Secretary Scott Bessent announced Tuesday that tariff revenues have reached approximately $100 billion so far in 2025, with projections rising to $300 billion by year-end due to President Donald Trump’s aggressive trade policies. Speaking at a White House cabinet meeting, Bessent emphasized that most of the collections began in the second quarter, following the implementation of a sweeping 10% tariff on nearly all U.S. imports and increased duties on steel, aluminum, and automobiles.

The $300 billion estimate applies to the calendar year ending December 31, 2025, rather than the government’s fiscal year ending September 30. Achieving this would require a sharp acceleration in tariff collections and further expansions to current tariff rates.

According to the Treasury, gross customs duties hit a record $22.8 billion in May, nearly quadrupling from $6.2 billion a year earlier. From October through May, fiscal year 2025 collections totaled $86.1 billion, while calendar year collections through May reached $63.4 billion. By June 30, combined customs and excise tax collections surpassed $122 billion.

Bessent noted that the Congressional Budget Office projects $2.8 trillion in tariff income over the next decade, although he believes that figure may be too conservative.

President Trump reaffirmed his tariff push, announcing that beginning August 1, new “reciprocal” tariff rates will apply to nearly all U.S. trading partners. He also signaled potential negotiations to lower tariffs for certain countries. In addition, Trump revealed plans for a 50% tariff on copper imports, with further duties expected on semiconductors and pharmaceuticals.

As tariff policy becomes central to Trump’s economic agenda, the surge in collections highlights its significant impact on trade, inflation, and global supply chains.

Trump Allegedly Sought Airport, Penn Station Renaming in Exchange for Hudson River Tunnel Funding

Trump Allegedly Sought Airport, Penn Station Renaming in Exchange for Hudson River Tunnel Funding  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  U.S. to Begin Paying UN Dues as Financial Crisis Spurs Push for Reforms

U.S. to Begin Paying UN Dues as Financial Crisis Spurs Push for Reforms  US Pushes Ukraine-Russia Peace Talks Before Summer Amid Escalating Attacks

US Pushes Ukraine-Russia Peace Talks Before Summer Amid Escalating Attacks  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  China Warns US Arms Sales to Taiwan Could Disrupt Trump’s Planned Visit

China Warns US Arms Sales to Taiwan Could Disrupt Trump’s Planned Visit  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Japan Election 2026: Sanae Takaichi Poised for Landslide Win Despite Record Snowfall

Japan Election 2026: Sanae Takaichi Poised for Landslide Win Despite Record Snowfall  Trump Signs “America First Arms Transfer Strategy” to Prioritize U.S. Weapons Sales

Trump Signs “America First Arms Transfer Strategy” to Prioritize U.S. Weapons Sales  Trump Allows Commercial Fishing in Protected New England Waters

Trump Allows Commercial Fishing in Protected New England Waters  U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday

U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions