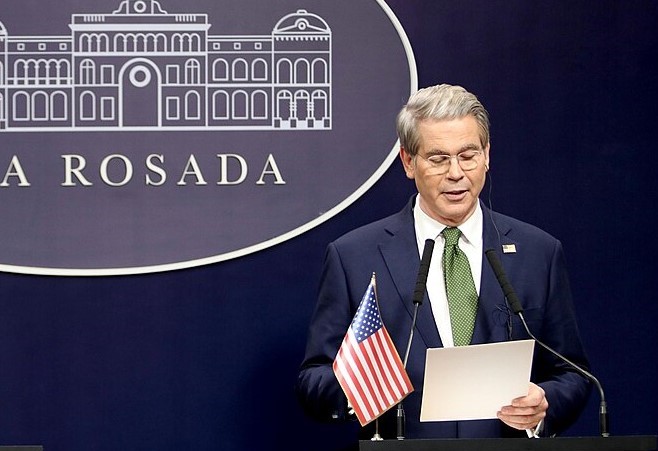

The United States may lift additional sanctions on Venezuela as early as next week to facilitate oil sales and economic stabilization, according to comments by U.S. Treasury Secretary Scott Bessent in an interview with Reuters. The move is part of the Trump administration’s broader strategy to revive Venezuela’s economy, stabilize the country, and encourage the return of U.S. oil producers following the recent arrest of Venezuelan leader Nicolas Maduro on drug trafficking charges.

Bessent said the Treasury Department is actively reviewing sanctions related to Venezuelan oil, particularly those affecting crude stored on ships. The goal is to allow oil sale proceeds to be repatriated back to Venezuela to fund government operations, security services, and public needs. While Bessent did not specify which sanctions could be lifted, he emphasized that changes could come quickly.

A major focus of the U.S. effort is unlocking Venezuela’s frozen International Monetary Fund Special Drawing Rights. Venezuela holds roughly 3.59 billion SDRs, valued at nearly $5 billion, which it has been unable to access due to sanctions. Bessent said the U.S. Treasury would be willing to convert these SDRs into U.S. dollars to help rebuild Venezuela’s economy. He is also scheduled to meet next week with the heads of the IMF and World Bank to discuss their potential re-engagement with the country.

U.S. sanctions have long prevented international banks and creditors from dealing with Venezuela, complicating a widely anticipated $150 billion debt restructuring seen as critical for attracting private investment. To protect future revenues, President Donald Trump signed an executive order blocking courts or creditors from seizing Venezuelan oil revenue held in U.S. Treasury accounts.

Bessent expressed confidence that smaller private oil companies would move rapidly back into Venezuela, while Chevron is expected to expand its long-standing presence. He also suggested the U.S. Export-Import Bank could help guarantee financing for Venezuela’s oil sector, potentially accelerating recovery and foreign investment.

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Jack Lang Resigns as Head of Arab World Institute Amid Epstein Controversy

Jack Lang Resigns as Head of Arab World Institute Amid Epstein Controversy  Trump Allows Commercial Fishing in Protected New England Waters

Trump Allows Commercial Fishing in Protected New England Waters  Trump Appoints Colin McDonald as Assistant Attorney General for National Fraud Enforcement

Trump Appoints Colin McDonald as Assistant Attorney General for National Fraud Enforcement  US Pushes Ukraine-Russia Peace Talks Before Summer Amid Escalating Attacks

US Pushes Ukraine-Russia Peace Talks Before Summer Amid Escalating Attacks  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Trump Signs “America First Arms Transfer Strategy” to Prioritize U.S. Weapons Sales

Trump Signs “America First Arms Transfer Strategy” to Prioritize U.S. Weapons Sales  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Nighttime Shelling Causes Serious Damage in Russia’s Belgorod Region Near Ukraine Border

Nighttime Shelling Causes Serious Damage in Russia’s Belgorod Region Near Ukraine Border  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Pentagon Ends Military Education Programs With Harvard University

Pentagon Ends Military Education Programs With Harvard University  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  U.S. Announces Additional $6 Million in Humanitarian Aid to Cuba Amid Oil Sanctions and Fuel Shortages

U.S. Announces Additional $6 Million in Humanitarian Aid to Cuba Amid Oil Sanctions and Fuel Shortages  China Warns US Arms Sales to Taiwan Could Disrupt Trump’s Planned Visit

China Warns US Arms Sales to Taiwan Could Disrupt Trump’s Planned Visit  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Trump Says “Very Good Talks” Underway on Russia-Ukraine War as Peace Efforts Continue

Trump Says “Very Good Talks” Underway on Russia-Ukraine War as Peace Efforts Continue