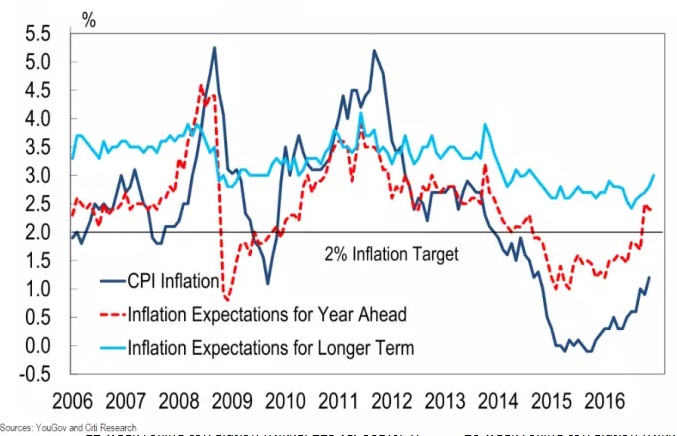

According to a Citi/YouGov poll, the long-term inflation expectation, which is for 10 years has reached 3 percent, the highest level since September 2014. It is up from 2.8 percent level seen in the previous survey. It also marks the fifth consecutive monthly increase in the wake of the referendum in June, in which the majority of the Britons voted in favor of moving out of the European Union.

However, the 3 percent number is still below the all-time high of 4.1 percent seen in 2011 and the long-term average of 3.3 percent. The alarming isn’t the level but the pace of the rise in expectations. Within a matter of months, the inflation expectation is up by more than 20 percent. One of the biggest reasons behind the move has been the decline in the Pound which has dropped. It has declined more than 18 percent since the referendum, leading to an increase in the cost of imports.

The same survey also reports that British consumers’ expect price rise of 2.43 percent over the next 12 months, whereas the Bank of England (BoE) has forecasted a rise of 2.7 percent. This fast rise has also prompted the central bank to indicated that the probability of rate hike is equal to that of a cut.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.

Fed Confirms Rate Meeting Schedule Despite Severe Winter Storm in Washington D.C.  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off