The news that UK printed newspapers are continuing to lose circulation comes as no surprise, extending – as it does – a trend that has been gathering pace for two decades after digital media began to cannibalise print sales.

But the latest release of Audit Bureau of Circulation (ABC) circulation figures came with a postscript. The ABC announced it had been informed that the Telegraph Media Group would no longer take part in the ABC’s audit that, for decades, has been the Holy Grail for the industry and advertisers.

The Telegraph justified its decision by explaining that the ABC metric was not how it measured its success. In its press release the company said it was focused on a subscriber-first strategy underpinned by “long term investment in digital transformation”.

The ABC metric is not the key metric behind our subscription strategy and not how we measure our success.

What is surprising isn’t The Telegraph’s decision to leave, but that it took this long for a national heavyweight to make this move, given the growing and increasing reliance on digital in today’s multi-channel news consumption marketplace. Of course, while The Telegraph’s stated aim is 10 million registrations and one million paying subscribers by 2023, transforming the available digital eyeballs into long-term paying subscribers won’t be easy.

Inevitably, more publishers are trying to charge for content to sustain their newsrooms in the face of falling advertising revenue. But the Reuters Digital News Report 2019 highlighted the battle they face, revealing only 7% of those surveyed in the UK said they had committed to ongoing payments for online news in January/February 2019. Compare that to top-of-the-league Norway where it was a heady 27% of those sampled.

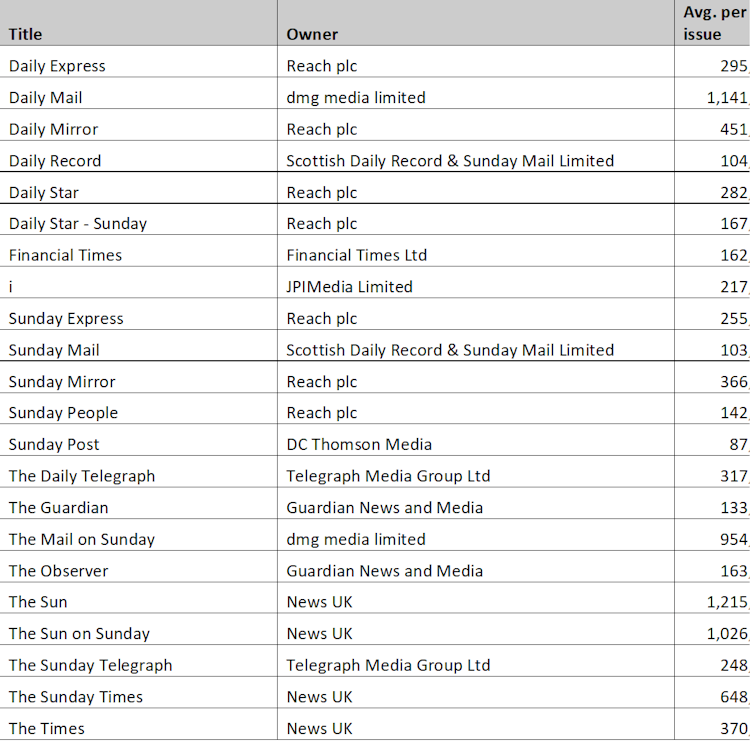

UK national newspaper circulation December 2019. ABC

Interestingly, The Telegraph reported 44% growth in digital subscriptions in 2019, taking it to 213,868 and for the first time exceeding its 209,443 print subscriptions. Last month the Telegraph achieved record subscriptions and a record number via mobile. Those encouraging statistics may have prompted the decision to leave the ABC.

The group is aggressively marketing its digital subscriptions. Currently enlisting for an annual high-end Telegraph digital subscription – which offers access to all articles on telegraph.co.uk and digital editions of the paper each day to read on a mobile device (£200) – comes with a sweetener of a high-end Fitbit which is worth close to £200. That’s attractive. The challenge will be persuading these subscribers to stick around after 12 months.

The Guardian has shown how brokering these new relationships (as well as pursuing an aggressive cost-cutting strategy) can be effective, announcing last May it had broken even at operating EBITDA level. The group’s three-year-strategy reduced costs by 20% (partly as a result of redundancies) and boosted the newspaper’s digital presence, with an increase in its total monthly page views from 790 million in April 2016 to 1.35 billion page views in March 2019.

Importantly, the Guardian revealed that 55% of its revenues were now digital, highlighting “good growth in digital advertising, digital subscriptions and reader contributions”. And it confirmed more than 655,000 monthly paying “supporters”, plus an additional 300,000 people who had made a one-off contribution in the previous year under its “Support the Guardian’s journalism” scheme.

Print v digital

The downward trend in print circulation that all publishers are battling has gathered pace in the past decade. The Ofcom News Consumption Report for 2019 released last summer reported a fall of 52.5% for UK national newspaper print circulation, down from 22 million in 2010 to 10.4 million in 2018.

And as anyone working in newspapers knows, online audiences have become increasingly important, as well as facing head-on the challenge from social media as a news source, with nearly half of all adults in the Reuters report saying they use it for news.

Inevitably, as online audiences get bigger, the drive to grow digital advertising revenues gathers pace. Advertising clients already expect to be quoted digital success figures, from the number of page views a site receives each month to unique user numbers or the average engagement time.

And, as many in the industry agree, focusing on growing audience numbers is just as important as managing newspaper sales numbers to maintain the ABC figures. As one senior newspaper executive said:

It’s a bold move [by The Telegraph] to step away from the ABCs but their decision to focus on digital registered users and online subscribers is a strong nod towards their belief in the growing success of digital journalism.

Of course as The Sun and The Daily Mail vie for top slot it suits both to stay within the current ABCs. There’s bragging rights at stake. But, for The Telegraph, where was the value in staying? In December 2002 it sold around 933,525 papers each day. After 17 years, showing the seismic shift seen across the industry, its total average print circulation for December 2019 was 317,817, down 12% year on year.

The Times fared better in the latest audit, but only just, dropping by 11% to 370,005 with 53,284 bulk sales – meaning those given away in hotels, airports and the like. Over the same period, the Financial Times fell 10% to 162,429, with 29,783 bulk sales and the Guardian’s circuation fell by 5% to 133,412.

It was the same story for the Sunday “quality” rivals. Again the Telegraph stable experienced the highest percentage fall, the Sunday Telegraph’s 12% drop to 248,288 was 3% worse than The Sunday Times whose 9% took them to 648,812, with 50,808 bulks, while the Observer had the greatest cause for encouragement with an overall fall of only 2% and figures of 163,449.

It was the Sun wot won it – just

It remains to be seen if ABC methodology will change. The ABC statement was conciliatory, acknowledging the Telegraph’s wish to promote “growing subscription numbers across print and digital”, but adding the best route would be “an industry-agreed ABC standard”.

ABC said it was: “open to working with the Telegraph, as with all publishers, on developing metrics which support their strategies”.

Interestingly, December’s traditional ABC figures were accompanied by a new metric – measuring total circulated copies, which refers to “the complete number of copies distributed by media owners” and is calculated by multiplying each title’s number of issues by their monthly ABC figure, then aggregating across the year.

Under that metric, The Telegraph ranked fifth in national daily newspapers with 97.1 million for January to December 2019 – only beaten among daily broadsheets by The Times, which sold 115.5 million copies. Achieving a new industry-agreed ABC standard to capture subscription numbers across print and digital would be progress, albeit long overdue – the only surprise is it hasn’t happened sooner.

But until the ABC metrics change, the most fascinating aspect will be whether The Sun can retain the accolade of the UK’s top-selling newspaper. With the red top newspaper’s total average circulation of 1,215,852 declining 13% year-on-year – compared to a fall for the Daily Mail of just 7% to 1,141,178, there well be change at the top in 2020.

Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO