Senate Republicans unveiled major changes to President Donald Trump’s sweeping tax and spending bill on Monday, intensifying internal GOP divisions ahead of the July 4 deadline. The updated proposal maintains the $10,000 cap on state and local tax deductions—far below the House's $40,000 limit—sparking backlash from House Republicans whose constituents would benefit from the higher cap.

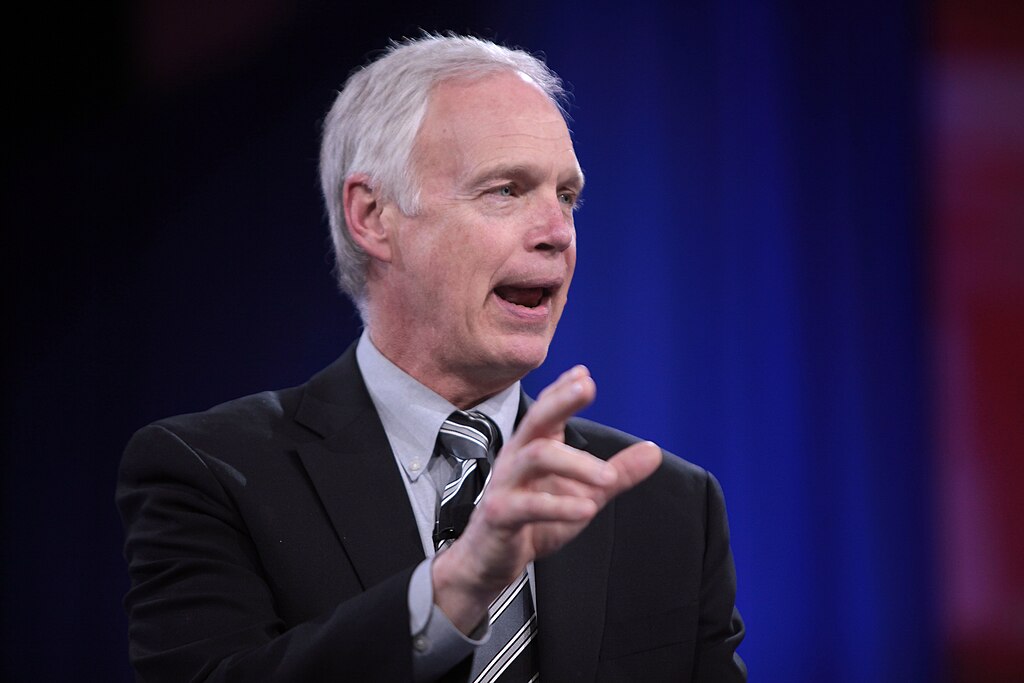

Senator Ron Johnson criticized the bill for failing to address the growing federal deficit, while others raised concerns about cuts to Medicaid. Senator Josh Hawley warned that capping Medicaid provider taxes could devastate rural hospitals. The nonpartisan Congressional Budget Office previously projected the bill could leave 4.8 million Medicaid recipients uninsured.

The revised bill includes permanent business tax breaks, such as full expensing for domestic R&D and new machinery investments, which were temporary in the House version. It also phases out Biden-era green energy and EV subsidies more aggressively, leading to a drop in solar stock prices.

Another controversial provision includes capping deductions on tipped income and overtime pay, with thresholds phasing out above $150,000 for individuals. A retaliatory tax on foreign investors is also maintained, though delayed until 2027.

The bill boosts military and border security funding and raises the debt ceiling by $5 trillion to avoid default on the $36.2 trillion national debt. With narrow GOP control in both chambers, the legislation faces resistance from fiscal hawks and social policy advocates, and is unlikely to gain any Democratic support.

Senator Mike Crapo emphasized continued collaboration with House Republicans and the Trump administration to push the bill forward. Debate continues as Senate leaders aim to reconcile differences and finalize the legislation before the deadline.

Faith Leaders Arrested on Capitol Hill During Protest Against Trump Immigration Policies and ICE Funding

Faith Leaders Arrested on Capitol Hill During Protest Against Trump Immigration Policies and ICE Funding  New York Legalizes Medical Aid in Dying for Terminally Ill Patients

New York Legalizes Medical Aid in Dying for Terminally Ill Patients  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Panama Supreme Court Voids Hong Kong Firm’s Panama Canal Port Contracts Over Constitutional Violations

Panama Supreme Court Voids Hong Kong Firm’s Panama Canal Port Contracts Over Constitutional Violations  Trump Signs “America First Arms Transfer Strategy” to Prioritize U.S. Weapons Sales

Trump Signs “America First Arms Transfer Strategy” to Prioritize U.S. Weapons Sales  Federal Judge Blocks Trump Administration Move to End TPS for Haitian Immigrants

Federal Judge Blocks Trump Administration Move to End TPS for Haitian Immigrants  Trump Allows Commercial Fishing in Protected New England Waters

Trump Allows Commercial Fishing in Protected New England Waters  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  U.S. Justice Department Removes DHS Lawyer After Blunt Remarks in Minnesota Immigration Court

U.S. Justice Department Removes DHS Lawyer After Blunt Remarks in Minnesota Immigration Court  U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday

U.S. Lawmakers to Review Unredacted Jeffrey Epstein DOJ Files Starting Monday  Trump Says “Very Good Talks” Underway on Russia-Ukraine War as Peace Efforts Continue

Trump Says “Very Good Talks” Underway on Russia-Ukraine War as Peace Efforts Continue  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Netanyahu to Meet Trump in Washington as Iran Nuclear Talks Intensify

Netanyahu to Meet Trump in Washington as Iran Nuclear Talks Intensify  Jack Lang Resigns as Head of Arab World Institute Amid Epstein Controversy

Jack Lang Resigns as Head of Arab World Institute Amid Epstein Controversy  Pentagon Ends Military Education Programs With Harvard University

Pentagon Ends Military Education Programs With Harvard University